The stablecoin revolution is here, and it’s transforming how we think about money. In a recent webinar hosted by Crystal Intelligence in collaboration with two highly regarded institutions, Bocconi University in Italy and Spain’s IE University, three industry leaders shared insights on how stablecoins are bridging traditional finance with blockchain technology.

Moderating the panel was Diego Salazar, Head of Business Growth in Latin America (LATAM) and Western Europe at Crystal Intelligence. His guests were:

- Emanuele Rossi:Stablecoin Business Development Leader at Anchorage Digital;

- Gijs op de Weegh:Founder and CEO of StablR; and

- Andrea Marsili: Innovation Partner at MoonPay.

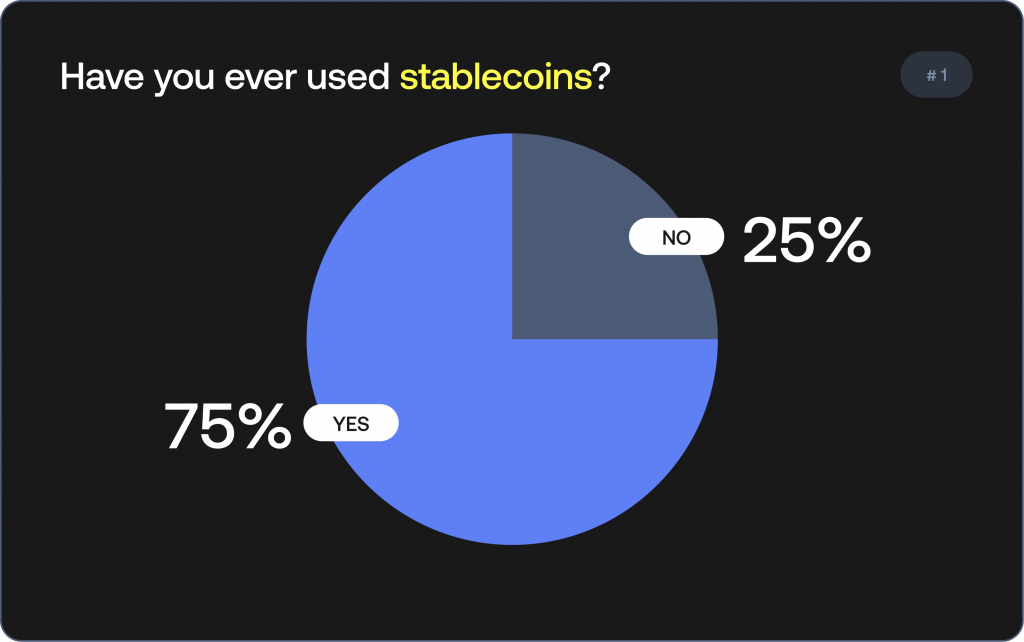

Several audience polls were also conducted during the webinar, yielding interesting results for all stakeholders in the stablecoin industry. So, let’s dive in.

What are stablecoins and why do they matter?

Emanuele Rossi from Anchorage Digital, the first and only federally chartered crypto bank in the United States, explained that stablecoins are essentially digital representations of traditional currencies that reside on the blockchain. Unlike volatile cryptocurrencies, stablecoins maintain a stable value by being pegged to fiat currencies, such as the US dollar or the euro.

He defined it as “internet-native money,” which transforms the financial system from a patchwork of middlemen and financial service providers reliant on decades-old technology to a form of money built on blockchains, making it available 24/7 and both fully composable and programmable.

Gijs op de Weegh of StablR, a MiCA-compliant stablecoin issuer in Europe, mentioned that stablecoins create opportunities for people and regions that previously lacked access to the financial ecosystem, thereby easing the global flow of money. He also noted that StablR has launched two stablecoins—EURR (euro-backed) and USDR (USD-backed)—and has already facilitated over $9 billion in trading volumes across more than 60 venues in just nine months.

Andrea Marsili added that, until now, building a financial application required relying on a siloed and centralized banking system. With stablecoins powered by blockchain, consumers have greater choice. They can choose which blockchains they prefer, opting for those that are cheaper, faster, and less centralized.

Poll 1:

A full 75% of the webinar audience have used or do use stablecoins.

Real-world use cases transforming everyday transactions

Andrea Marsili from MoonPay, a leading payment infrastructure provider that has partnered with Mastercard to mainstream stablecoin payments, highlighted how customer behavior has evolved from viewing crypto as purely an investment to using stablecoins for practical financial services. The phenomenon of UST usage for everyday purchases in parts of South America, Southeast Asia, Latin America, and even Africa is already well-established.

Savings and lending: Stablecoins can offer users significantly higher interest rate yields than traditional banks. As Op de Weegh pointed out, while European banks typically offer around 0.5% interest, DeFi platforms can provide 5-7.5%, which is up to 15 times more.Marsili suggested that improving blockchain technology will,over time, lead to increased usage of stablecoins for both saving and spending.

Cross-border payments and remittances: One of the most compelling use cases is international money transfers. Traditional remittance services can charge up to 20% in fees when sending money abroad, a situation which Op de Wegh described as “ridiculous”. With stablecoins, he explained, those costs can be reduced to approximately 2%.

Card payments: The panelists discussed the rapid growth of stablecoin-backed cards offered by exchanges and protocols, enabling users to spend their digital assets at traditional merchants worldwide.

Poll 2:

A full 72% of the stablecoin-using audience used them for someform of trading or another, while 19% of those used them for ‘other’ purposes. Equally striking was that none of them used them for savings or as a store of value.

Regulation: the foundation for mainstream adoption

The conversation turned to regulatory frameworks that are shaping the stablecoin landscape—specifically, the EU’s Markets in Crypto-Assets Regulation (MiCA) and the US Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act).

The GENIUS Act: Rossi explained that GENIUS provides much-needed clarity for the US stablecoin market. The legislation establishes two categories of requirements: operational considerations (like collateral requirements and service-level agreements for minting and burning) and licensing considerations (determining who can issue stablecoins). Anchorage Digital Bank, as a federally chartered institution, is positioned at the forefront of compliant stablecoin issuance under this framework.

MiCA in Europe: Op de Weeghnoted that while MiCA provides a legal framework for stablecoins, he expressed concerns about over-regulation and the influence of banking lobbies. The regulation prohibits issuers from offering yield directly on stablecoins and requires large portions of reserves to be held with European credit institutions.

He also cautioned that the continued ‘ringfencing’ of Europe could hinder the development of stablecoins, adding that the defensive position of insisting on euro-linked stablecoins in a USD market, given the 26-country-strong region’s 20% share of the world’s economy,placed it behind when compared to progress made by the GENIUS Act. He pointed out that Tether, the largest stablecoin issuer, decided not to comply withMiCA, viewing the requirements as overly burdensome.

A counterpoint to this position was raised by Andrea, who noted that MiCA’s relative maturity has seen consortia of traditional banks entering the stablecoin sphere faster than less experienced American institutions.

Despite these challenges, the panel generally agreed that both regulations represent crucial steps toward legitimizing stablecoins and enabling institutional adoption.

The future of stablecoin is programmable and borderless

All three panelists emphasized that the industry is only at the beginning of the stablecoin journey.

Rossi compared the evolution of the concept ofcross-border paymentsto that of email.He noted that the idea of“cross-border email” is ‘stupid’,yet cross-border payments are still something seriously discussed. He added that stablecoins can do for money what the internet did for messaging and communication—create a unified layer that enables 24/7 settlement and composability.

The panelists also discussed emerging opportunities in artificial intelligence and autonomous agents that will need programmable payment rails to function. Traditional banking infrastructure cannot support these use cases, making stablecoins a crucial component of future infrastructure.

Banking partnerships: the next critical step

For stablecoins to achieve mass adoption, Marsili stressed that traditional financial institutions must become more crypto-friendly. Currently, many banks reject crypto-related transactions, creating friction for users trying to move between fiat and digital currencies.

He explained that customers still struggle to on-ramp directly into crypto in a straightforward way because many banksdon’t accept crypto transactions through their accounts. He added thatonce thisbottleneck is removed, industry growth rates will improve dramatically.

Rossi noted that EU banks are increasingly interested in stablecoins but are still deliberating between launching their own tokenized deposits versus partnering with existing stablecoin issuers. In Europe, consortia of major banks, including ING, UniCredit, and Deutsche Bank, have already announced plans to launch their own euro stablecoins.

What this means for everyday stablecoin users

The webinar made clear that stablecoins aren’t just technical innovations, they represent a fundamental shift in how people can manage their financial lives:

- For individuals in developing countries: Stablecoins protectagainst currency devaluation and provide access to stable stores of value.

- For global workers: Nearly instant, low-cost remittances replace expensive traditional services.

- For savers: Access to competitive yields through DeFi lending markets.

- For businesses: Efficient cross-border payments and programmable payment infrastructure.

- For developers: Open, permissionless financial rails to build innovative applications.

As regulation continues to evolve and traditional financial institutions adapt, stablecoins are positioned to become a core component of the global economic system. The technology already exists—now it’s about building the bridges between traditional and decentralized finance.

Watch the full webinar recording on YouTube to hear the complete conversation and gain deeper insights into how stablecoins are transforming global finance: