Although stablecoins now anchor on-chain liquidity across multiple networks, most teams still find themselves stitching together their analyses from multiple resources to answer basic questions:

- What is the source of the funds?

- Where did these funds go?

- Who handled these funds?

- How do these transactions match regulatory compliance?

On Thursday, October 30, 2025, we launched Crystal Foresight, the stablecoin intelligence tool that unifies the analysis of cross-chain flows, issuance and redemptions, entity labels and risk, market microstructure, and MiCA-ready reporting.

Foresight delivers answers (not just questions), alerts (coming in 2026), and deep research drill-downs in a single, centralized, user-friendly interface.

At its core, Foresight is a stablecoin intelligence hub that integrates cross-chain transaction data with issuers and counterparties, customizable to each client’s needs and accessible in one place. This eliminates the need for threading together multiple data points from scattered resources to design business strategies or respond to market shifts.

Who benefits from Crystal Foresight?

Stablecoin issuers, Layer 1 and 2 blockchain networks, compliance and risk teams at exchanges, and market or business development leaders all gain from a unified intelligence layer.

Foresight users can expect live mapping of cross-chain fund flows, entity‑labeled counterparties, exchange and liquidity context, MiCA‑aligned reports, and programmable alerts via web and API

Product snapshot: The dashboard provides a market overview, on-chain transfer volumes, issuance and redemption, DEX/CEX trading volumes, and entities and labels.

Why stablecoin intelligence matters now

According to CEX.io, annual stablecoin transfer volumes in 2024 reached approximately USD$27.6 trillion, surpassing the combined transaction volumes of Visa and Mastercard by nearly 8 percent.

This surge demonstrates how stablecoins have moved from niche tools to central pillars of digital finance. Today, they rival traditional payment networks in scale, even superseding them in some jurisdictions, and the rapid uptake has spurred strong investor demand from issuers for the market opportunities that stablecoins now present.

Cross-chain activity across Ethereum, Tron, Solana, BNB, Polygon, Arbitrum, and Optimism has accelerated, yet visibility remains fragmented. Regulations such as the EU’s MiCA and the US Genius Act are driving institutional participation, increasing both trading volume and compliance requirements.

Teams now need accurate, up-to-date, and actionable cross-chain intelligence in a single, scalable database, rather than fragmented pieces from multiple sources.

The challenge: fragmented stablecoin visibility

Explorers are great for tracking transactions, but they’re not built for making decisions. Across the industry, we hear the same frustrations:

- Fragmented views: Cross-chain stablecoin transfers are often scattered across multiple networks.One entry could be on the source chain, another on the destination, and often a third could be linked to the bridge itself. Without a unified view, analysts are left stitching transactions together manually across different explorers.

- Entity ambiguity: Raw on-chain data only shows anonymous strings and balances, not who is behind them. This means analysts must piece together multiple label databases just to identify who uses a stablecoin and where.

- No “why” layer: Traditional explorers show where funds move, but not why. They lack order-book data from CEXs or DEXs, bid-ask spreads, or issuance and redemption events – all critical data for understanding market forces.

- Compliance gap: There is no unified system that maps sanctions lists, blacklists, or regulatory obligations across all stablecoin issuers and venues. Consequently, compliance enforcement is inconsistent, leaving gaps through which flagged wallets and risky transactions can slip.

Crystal Foresight – the stablecoin intelligence solution

Crystal Foresight closes these gaps and brings coherence to stablecoin markets by turning raw on-chain activity into intelligence for action.

- Cross-Chain Flow Charts track any USDT/USDC/DAI (and others) transfers across L1s, L2s, and bridges, combining them into end-to-end paths. They are customizable for businesses of any scale, as they can be toggled by token, chain, and bridge ranges, as well as timeframes.

- Entity-Labeled Counterparties identify issuers, exchanges, bridges, custodians, payment processors, and high-risk services, as well as addresses. These are carefully verified, consistently updated, and cataloged.

- Issuance and Redemption Monitor visualizes mint/burn activity and its impact on supply, peg stability, and inter‑exchange spreads.

- Market Microstructure Lens provides CEX/DEX liquidity snapshots and the performance of stablecoin pairs, including their depth, slippage, and cross‑venue flows, showing why volumes moved, rather than simply recording that they did so.

- Compliance & Risk Layer(MiCA‑ready) integrates sanctions lists, FATF‑relevant red flags, and risk heuristics.

- Programmable Alerts: notify users about market events such as large transfers, anomalous mints/burns, de‑pegs, or liquidity gaps. For instance, “notify me when ≥$X moves from/to [entity/chain/bridge]”.

- Modules include Market Overview, On‑chain Transfer Volumes, Issuance & Redemption, DEX/CEX Trading Volumes, Entities & Labels, Alerts, and APIs.

The net outcome for our customers is that they are empowered to move from asking“what happened?” to deciding “what I should do next.”

Stablecoin intelligence in action: the Spark.fi case

Using the Issuance and Redemption Monitor, we can analyze token supply dynamics and how they contribute to market cap, identify significant changes in mint and burn ratios, and what drives them.

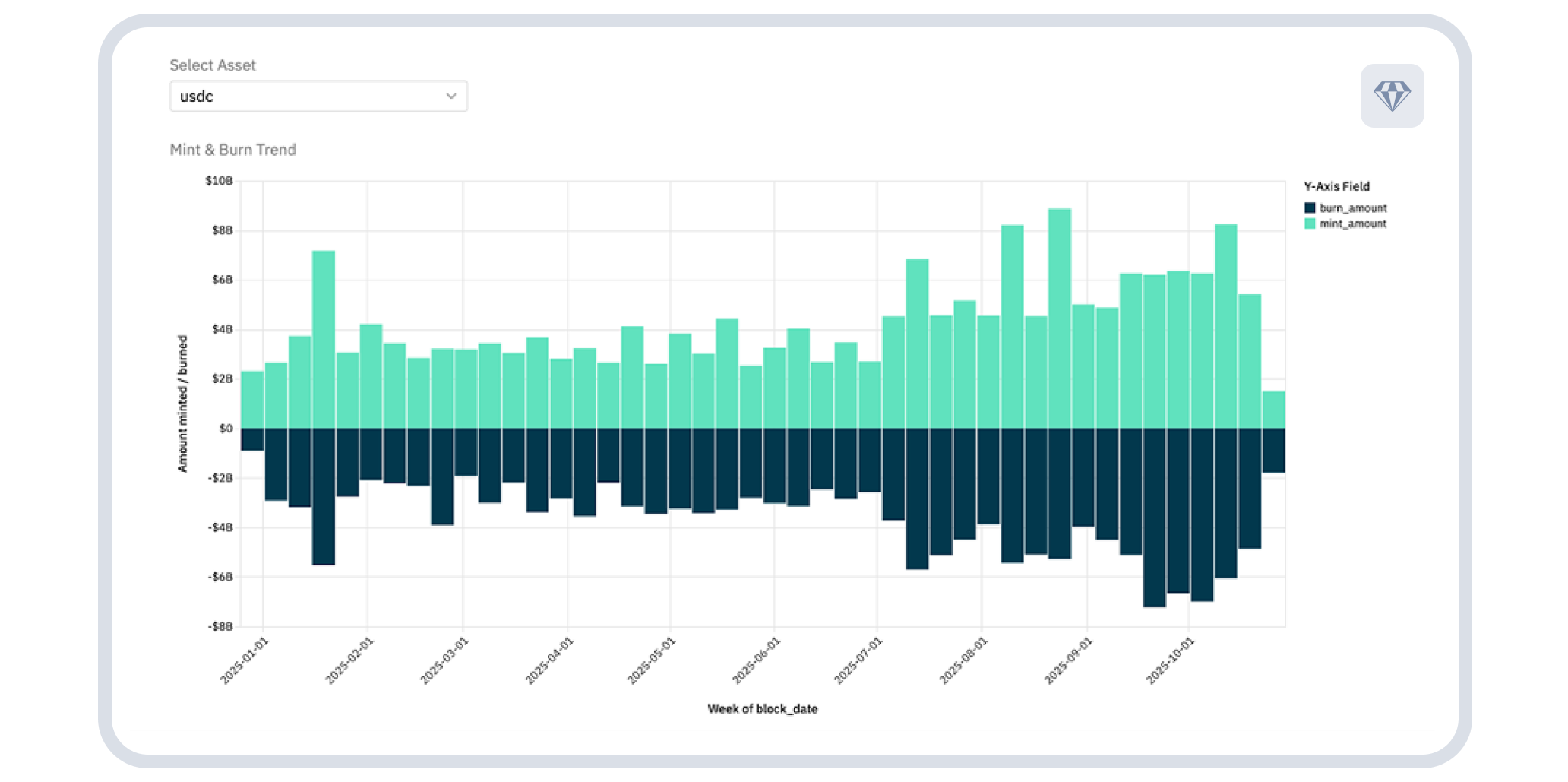

The chart above displays the weekly USDC mint and burn totals for 2025, from January 1 to mid-October 2025. Each pair of bars represents one week. The green bars show the volume of USDC minted, and the dark blue bars represent USDC burned (redeemed).

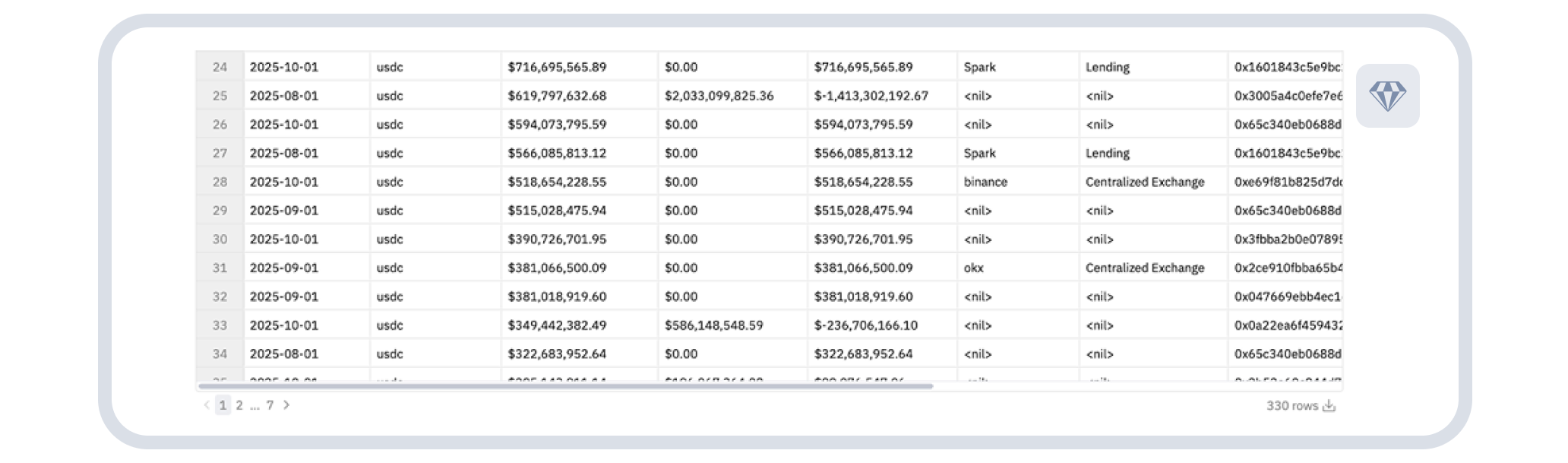

Moving through the “Top Mint Activity” over the last three months, the table lists 330 addresses according to their USDC minting and burning volumes for August to October 2025. It provides the block month, token symbol (all “USDC), gross USDC volumes minted and burned, the resulting net mint, the on‑chain entity name if known, and the entity’s primary category, as well as the address itself.

In this example, we focus on Spark.fi (line 27) – a DeFi lending protocol for stablecoins – one of the top minters of USDC as per the data shown.

Using Crystal Expert, our blockchain analytics tool, we can dig into what’s happening with Spark and USDC, where these funds are going, and the mechanisms for the Spark liquidity layer with USDC. This provides us with information about where they get their funds and where those funds are then sent.

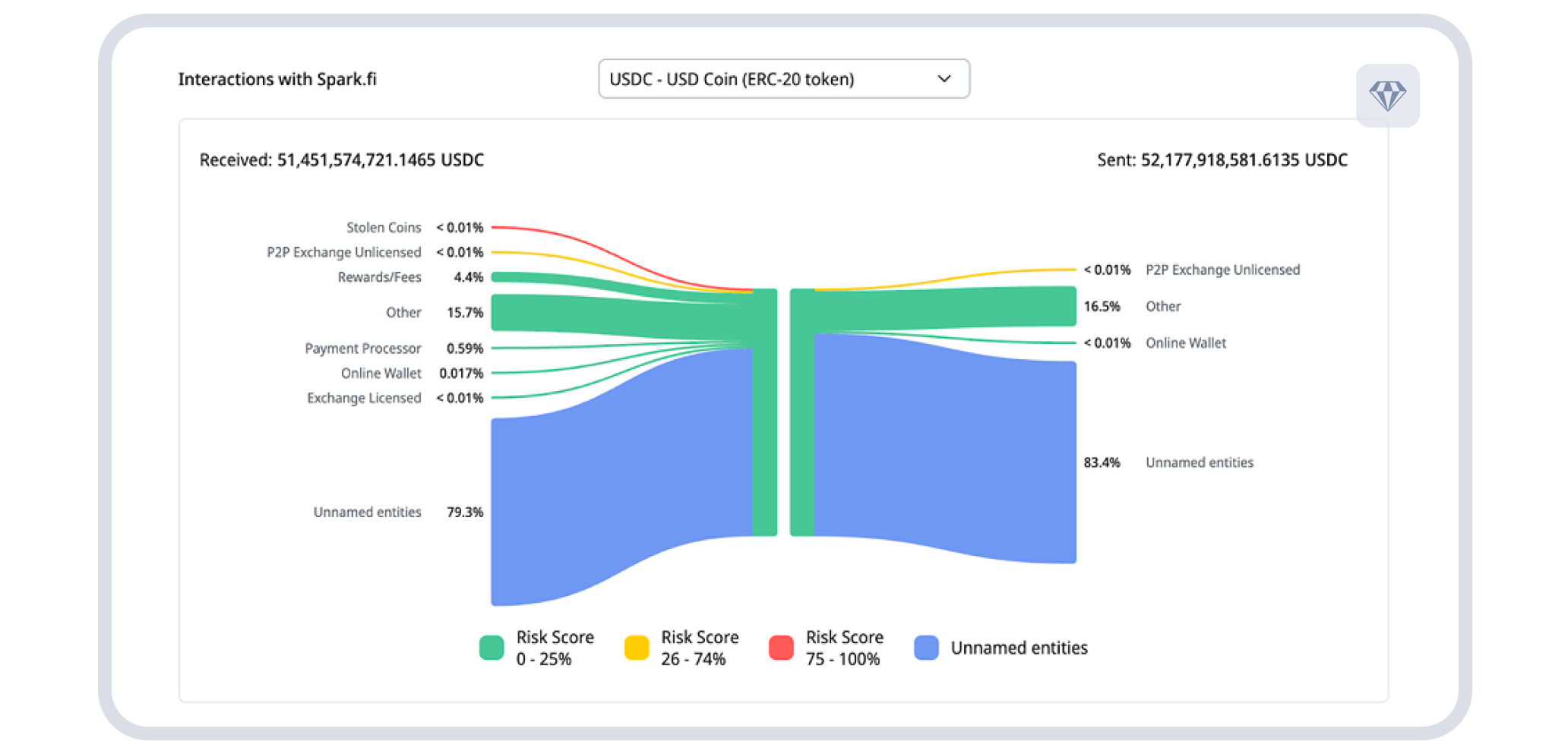

The diagram illustrates the flow of USDC in and out of the Spark.fi platform over the last three months.

On the left, the platform received about 51.45 billion USDC, and on the right, it sent out about 52.18 billion USDC.

Each segment represents the counterparty category (e.g. payment processors, online wallets, licensed exchanges, “other” transactions, etc.), and the color indicates the risk score of those interactions: green bars are low‑risk (0–25 %), yellow are medium‑risk (26–74 %) and red are high‑risk (75–100 %).

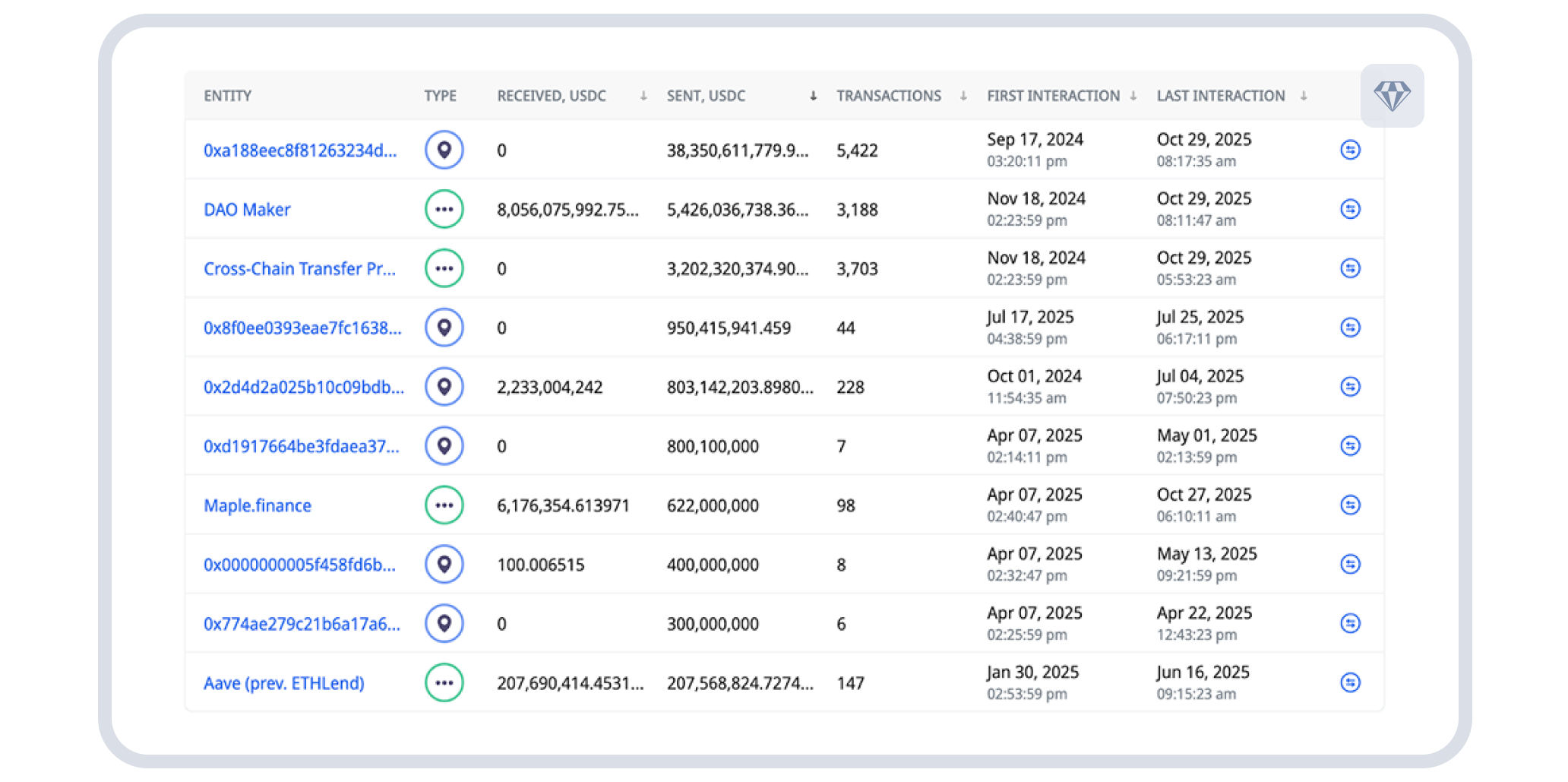

Below, we see the major counterparty and USDC flows between Spark.fi’s address and others. Named entities, such asDAO Maker, Circle’s Cross-Chain Transfer Protocol (CCTP), and Maple Finance, appear, with billions of USDC flowing through them.

Spark.fi sends large USDC volumes to CCTP, whichindicates native cross-chain liquidity movement (USDC burn on source → mint on destination).

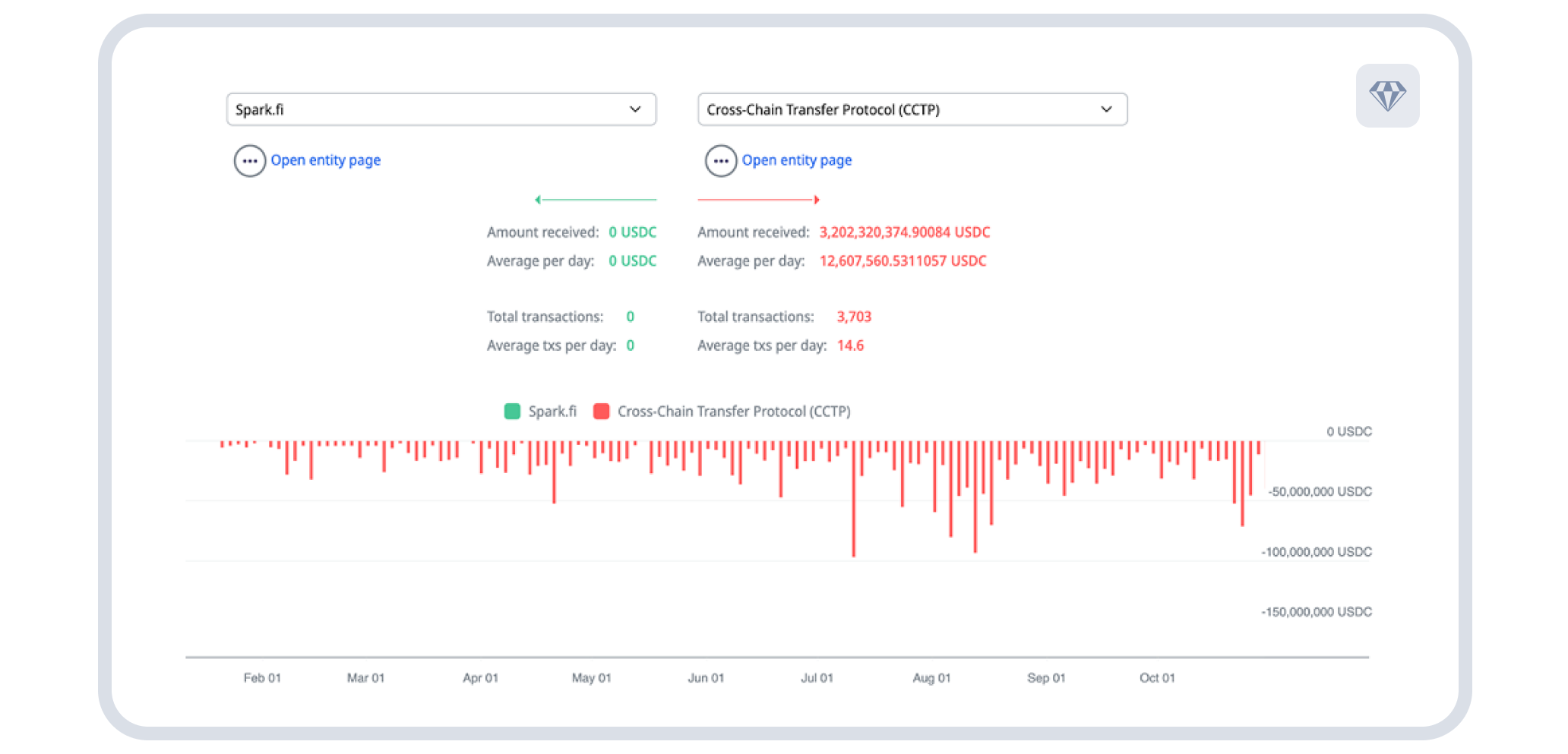

The visualization shows the USDC flow from Spark.fi to CCTP over time.

The visualization further demonstrates how Spark.fi’s interactions with the CCTP have evolved over time. The data shows a steady increase in activity throughout the past year, reflecting growing reliance on Circle’s native cross-chain infrastructure for USDC transfers. This upward trend makes it unsurprising that CCTP now ranks among Spark.fi’s top counterparties.

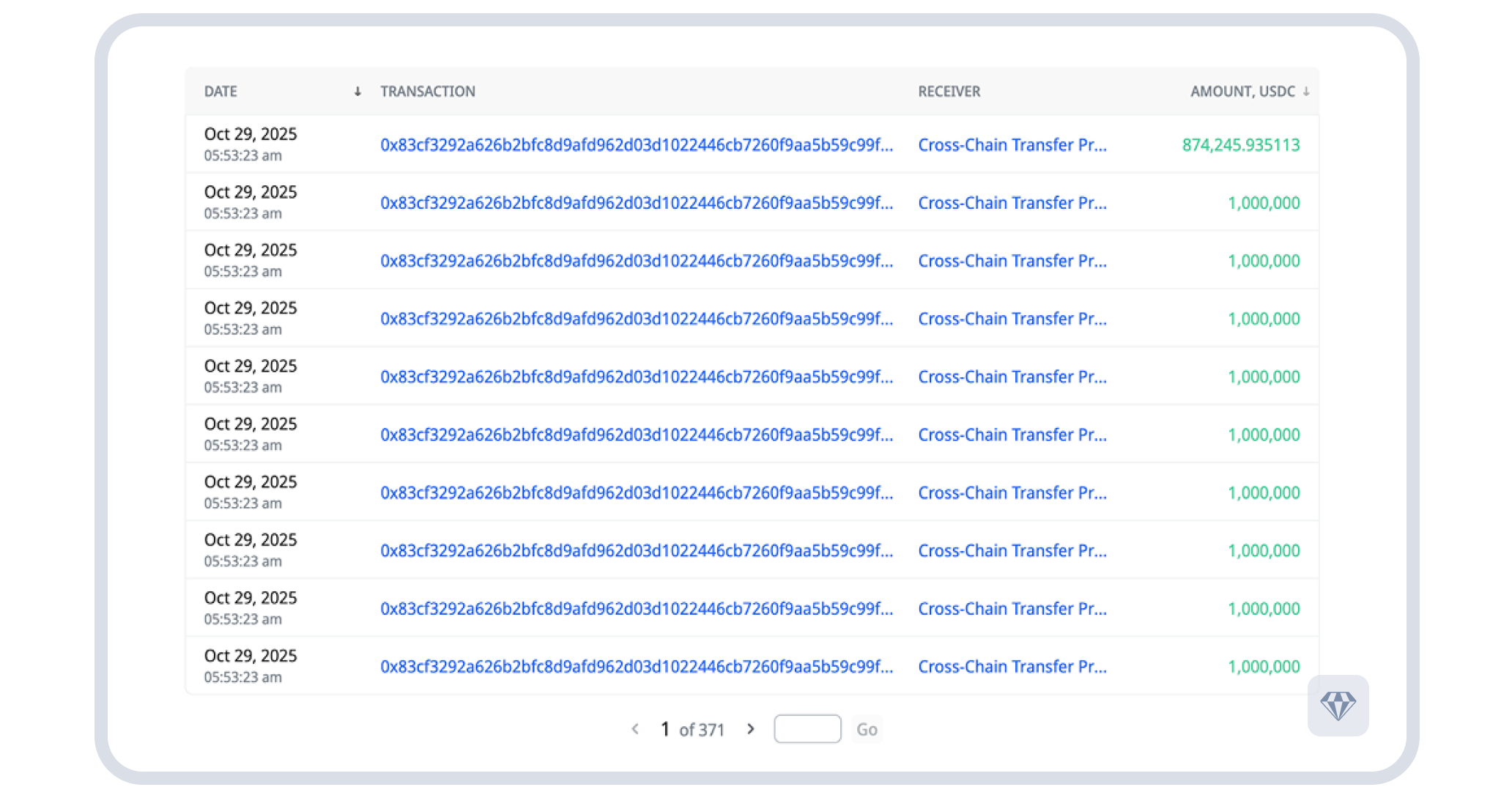

On average, Spark.fi executes around 15 transactions per day, sending approximately 12.7 million USDC daily through CCTP. These consistent, high-volume outflows highlight the protocol’s role as a core mechanism for liquidity movement across chains. From here, we can drill down further (transaction by transaction) to interrogate specific time periods, flow patterns, or counterparties and better understand how this cross-chain activity unfolds in practice.

Spark.fi executed a large batch of 1 million USDC transactions to CCTP within a second, totaling multiple millions of dollars in a single operation. This pattern reflects structured, automated cross-chain liquidity deployment, consistent with protocol-level treasury or bridge routing rather than retail activity.

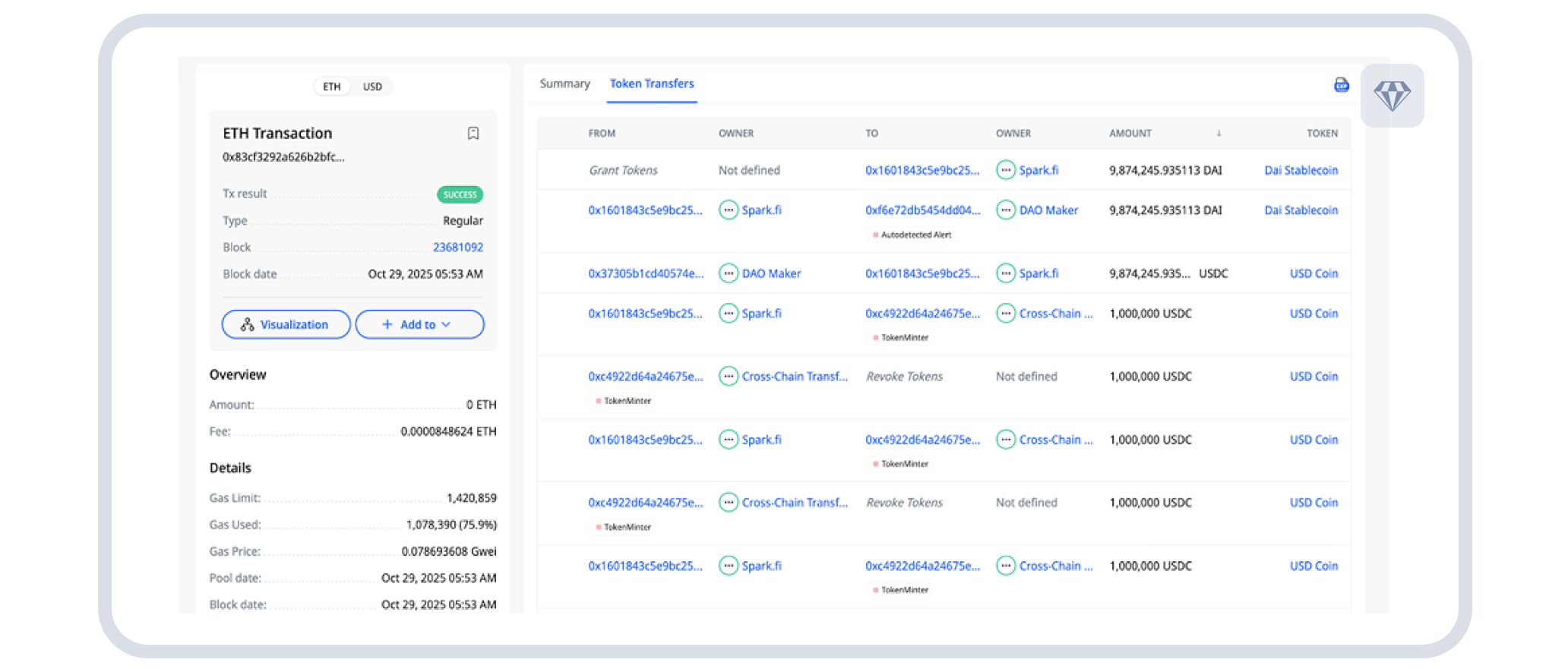

Spark.fi appears to be completing a full cross-chain liquidity cycle that starts with Circle’s CCTP and ends with DAO Maker.

Initially, Spark.fi receives native USDC minted by Circle’s Token Minter; representing the arrival of liquidity bridged from another chain.

Once on-chain, Spark.fi redistributes this USDC within the ecosystem, interacting with DAO Maker where the USDC is converted or used in exchange or lending operations.

The final stage shows Spark.fi sending approximately 9.87 million DAI back to DAO Maker, marking DAI as the final destination asset of this flow.

This pattern suggests Spark.fi is engaging in cross-chain liquidity management, using CCTP to import USDC liquidity and then settling or redeploying it as DAI within DAO Maker. This is likely to be part of a treasury rebalancing, yield, or credit provisioning strategy.

This example illustrates how Crystal Foresight and Crystal Expert, working in tandem, empower analysts to trace multi-chain flows from the initial minting through their cross-chain movements to their final asset conversion.

How Crystal Foresight stands apart from other explorers

There’s growing momentum around the use of cross-chain stablecoin explorers, which are public tools that consolidate multiple chains and tokens. Crystal Foresight differs from these tools in four ways:

- From explorer to intelligence: We understand and collate transactions within the market and compliance context, integrating issuance, liquidity, spreads, entities, and policy mappingsinto one investigative and operational view.

- Decision–ready, not just query–ready: Customizable alerts about market shifts, anomaly detection capabilities, cohorting, CSV/API exports, and MiCA reporting templates, ready for your use, turn monitoring into action.

- Customization by design: Supply the assets you want to see in your dashboard, the chains you are most concerned with, the specific metrics you want to track, and any additional features you need, and we will tailor a dashboard designed to your specifications to achieve your goals.

- Intelligence hours: Crystal goes beyond surface‑level analytics. Our team is dedicated to providing deep analyses of significant market events within your stablecoin ecosystem, such as sudden spikes in USDC volume. We deliver insights tailored to your organization’s needs and provide optimal strategic recommendations that optimize your business development plans.

What Crystal is launching now in Foresight

- Stablecoin token coverage: This includes USDT, USDC, USDE, USDS, DAI, USD1, and many more across major L1/L2s.

- Modules: Market Overview, On‑chain Transfer Volumes, Issuance & Redemption, DEX/CEX Trading Volumes, Entities & Labels, and Compliance.

- Access: Web app.

The takeaway

As capital flows accelerate across chains and entities, the ability to see how and why it moves is what separates reaction from foresight.

Crystal Foresight isn’t about a dashboard for the sake of data.

It’s about turning raw stablecoin flows into context-driven decision-making, soundly based on who’s transacting, where liquidity flows, and when the narrative shifts.

It’s your orientation layer for a market that never stops moving.

Discover Crystal Foresight, the intelligence layer for issuers, exchanges, and compliance leaders.