Crystal Intelligence hosted this webinar on methods and techniques for reporting and countering the increasing threat of crypto scams. It brought together industry experts to discuss the development of the scam industry, why comprehensive reporting mechanisms are critical, who the victims are and what the impact of fraud on them is, as well as how Crystal and its partners can help them and each other stem the damage and work towards a safer future for them and the industry.

Moderated by Nick Smart, the Chief Intelligence Officer at Crystal, the panel included:

- Sam Rogers: Associate Director of Product of Scam Alert at Crystal Intelligence, formerly at the Global Anti-Scam Alliance (GASA).

- Wendy Langridge: Regulatory and Governance Consultant, and Chief Compliance Officer (CCO) at the Agman Group.

- Mark Fetterhof: Senior Advisor at the American Association of Retired Persons’(AARP).

Compliance professionals, law enforcement agents (LEAs), and crypto crime investigators will all benefit from the panelists’ keen observations into the myriad directions blockchain crime is taking and the strategies being employed to counter these multi-pronged threats.

Audience polls conducted during the webinar also provided valuable insights for victims and industry stakeholders alike:

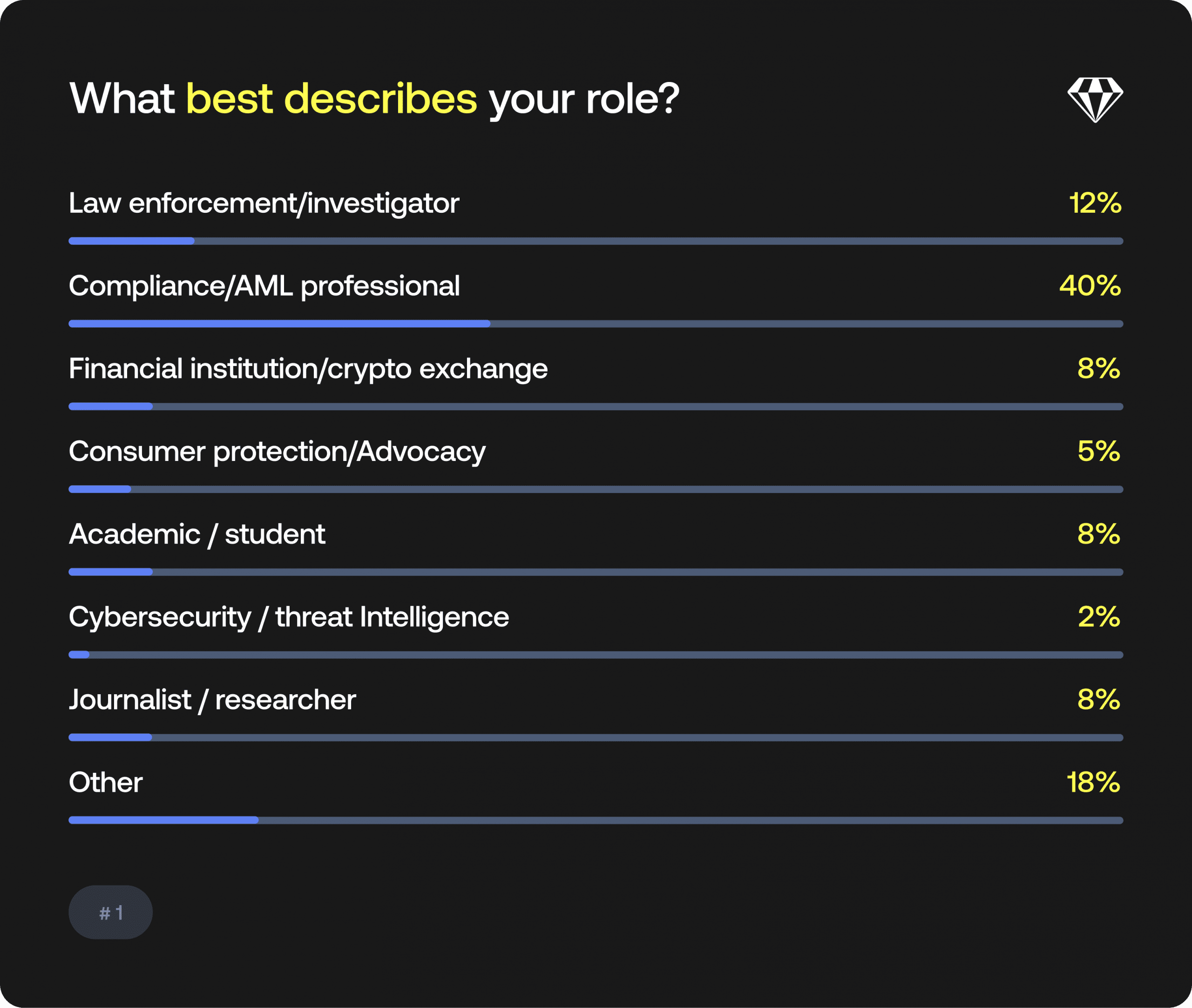

Poll #1: What best describes your role in the crypto industry?

Above: The majority of the audience were compliance/AML professionals.

Crypto fraud: the challenges that authorities and victims face

Sam drew on his experience at the coalface of consumer frustration during his tenure at the Global Anti-Scam Alliance (GASA) when he opened the discussion by highlighting the helplessness that victims feel, not knowing where to report their losses, or whom to.

Compounding this, the police are too often perceived as under-resourced and/or unresponsive to victims’ predicaments. Although he noted that some jurisdictions’ traditional banking sectors (TradFi), such as those in the UK, Singapore, and Australia, are becoming more proactive in addressing these issues, responses to crypto fraud still lag behind the ingenuity of tech-savvy criminals. Meanwhile, a growing data stockpile of potentially valuable intelligence remains underused.

The major crypto scam categories: old typologies, new tricks

Mark’s decade of leadership at the AARP reporting portal, the Fraud Watch Network, positioned him well to identify the most common typologies, which he listed as:

- Identity theft is now the number one complaint at the AARP, driven by massive data breaches worldwide.

- Business imposter scams, of late displaced at the head of the pack by the former, these fraud complaints accelerated during the pandemic as people relied on online corporations such as Amazon during lockdowns, exposing a new and inexperienced audience of victims to cybercriminals intent on fleecing them.

- Romance scams came third on Mark’s list, and they are proliferating in volume and impact, as scammers focus on building rapport with victims to exploit them over more extended periods before striking the killing blow.

The criminal emigration to crypto fraud

Wendy drew on her twenty-five years of compliance experience to illustrate that classic scams are increasingly going digital, encompassing fake investment schemes, fraudulent websites, identity theft, rug pulls, and fake coin offerings.

Fraudsters are increasingly drawn to cryptocurrency due to:

- Its relatively anonymous nature, coupled with the speed and irreversibility of transactions.

- Less regulated crypto environments than TradFi in some jurisdictions, accompanied by fewer, if any, consumer protection safeguards.

Understanding the scale of the crypto fraud problem

Estimates suggest triple-digit billions in cryptocurrency fraud losses, but the panel raised an important question: has the industry become numb to these staggering figures?

Wendy was the first to shed light on the question, using the UK’s example: While 40% of all financial crime is fraud, just 3% is perpetrated via cryptocurrencies. However, crypto frauds are disproportionately well-covered by the media due to spectacular but isolated high-value losses, primarily because of their scale and audacity.

Mark added the perspective of underreported victims, who may have lost their comparatively ‘minor’ life savings or investments: “It’s not always about the amount lost during the situation, but it’s about the amount lost to that person,” he said.

Seasonal patterns of crypto fraud reporting

One of Crystal’s Scam Alert innovations is the comparative analysis of seasonal trends in crypto fraud reporting by individuals over the last five years, which was revealing. Among the findings were:

- Spring Peaks (in the Northern Hemisphere) from March to June, possibly coinciding with periods when scammers target victims processing tax rebates and holiday allowances, and the business end-of-year.

- Autumn slump from August to September, possibly due to the Northern Hemisphere Summer months being popular vacation times during which potential victims use their funds more prolifically, resulting in less available cash to scam for fraudsters.

- December and January trends pick up again, which Wendy suggested could be related to seasonal scams, citing the example of Winter Fuel Rebate scams in the UK, which she implied have become an almost ritualistic annual event.

Mark added that, parallel to seasonal scam trends, romance scams can be protracted over weeks, months, or even years, as part of long-term strategies. Fraudsters insinuate themselves into their victims’ lives and finances over time, cultivating an intimate knowledge of both, before making the final, most devastating cuts.

Why victims report scams

Contrary to what many may believe, that the main motive is recovery, many report scams to help others from being defrauded.

Mark highlighted that the AARP Watch Fraud Network, which reaches over 40 million people, and records calls from victims discussing their hopes of recovering funds, shows a high level of altruism: victims report losses they cannot recover but hope that by adding to fraud trend databases with organizations like AARP, they can help others avoid scams.

Nick expressed some elation that the ‘broad church’ of the crypto ecosystem still has such a human face.

The language of crypto fraud trends

One of the behind-the-scenes activities of Crystal’s Scam Alert team is the analysis of the words and phrases that scammers use in their correspondence when probing potential victims:

- Words: ‘Bitcoin’, with over 120,000 hits by frequency, followed by ‘video’ (just under 12,000 hits), and ‘address’ (over 80,000) were the top three words incorporated into scam correspondence, while the abbreviation, BTC’ (over 40,000 hits), was also frequently used.

- Phrases: Again, Bitcoin featured prominently. ‘Bitcoin address’ (over 20,000 hits), ‘send video’ (almost 20,000 hits), and ‘buy bitcoin’ (about 7,000 hits) were the top three.

Wendy correlated these language trends according to three primary psychological tactics that fraudsters employ:

1. Fear and urgency: Scammers try to instill a false sense of panic in possible victims about immediate requirements they must fulfil to prevent losses or comply with laws, often using phrases like ‘malware detected’, ‘urgent action required’, or ‘full access to systems’.This tactic manipulates victims into divulging sensitive information or details out of fear while they are thinking irrationally.

2. Too good to be true (TGTBT): Criminals attempt to fool potential victims into thinking that they are eligible for quick wins, such as prizes, gifts, or spectacular investment returns. This preys on the human weakness for easy wins.

3. Authority and Legitimacy: Fraudsters claim to be representatives of legitimate authorities, using phrases such as ‘authorized’ or ‘registered firm’ to convince victims that they need to verify account information or update payment details. This leverages human trust in authority figures to gain access to victims’ personal information and control of their accounts.

The shame factor: how victims’ embarrassment about being scammed affects crypto fraud reporting

In addition to the general fear among victims that their losses, despite their devastating impact, are insufficient to call for significant investigative action by authorities, the panel concurred that embarrassment is a recurring theme among victims who delay or do not report being scammed.

Victims can be reticent about reporting being scammed out of their fear of judgment (and worse) from family, friends, employers, and even fellow worshippers, depending on the compromising content they’ve revealed to scammers.

Ironically, the victims targeted can be as diverse as teenage boys prone to sextortion scams in which they’ve unwittingly surrendered compromising images or information to scammers in honeytraps and are now being blackmailed, and elderly victims concerned that revealing their predicaments to family or trusted others could reflect on their mental capacity to manage their financial affairs.

The critical first 48 hours in reporting crypto fraud

When fraud occurs, speed is crucial for compliance officers and investigators. They need as much technical detail as the victims can muster, including:

- Technical data, such as transaction hashes and wallet addresses- these unique ID indicators will help investigators track crypto movements.

- Communication data, including communication records via whatever channels, media posts, and texts, to establish the timeline of events.

The challenges investigators face in crypto fraud reporting

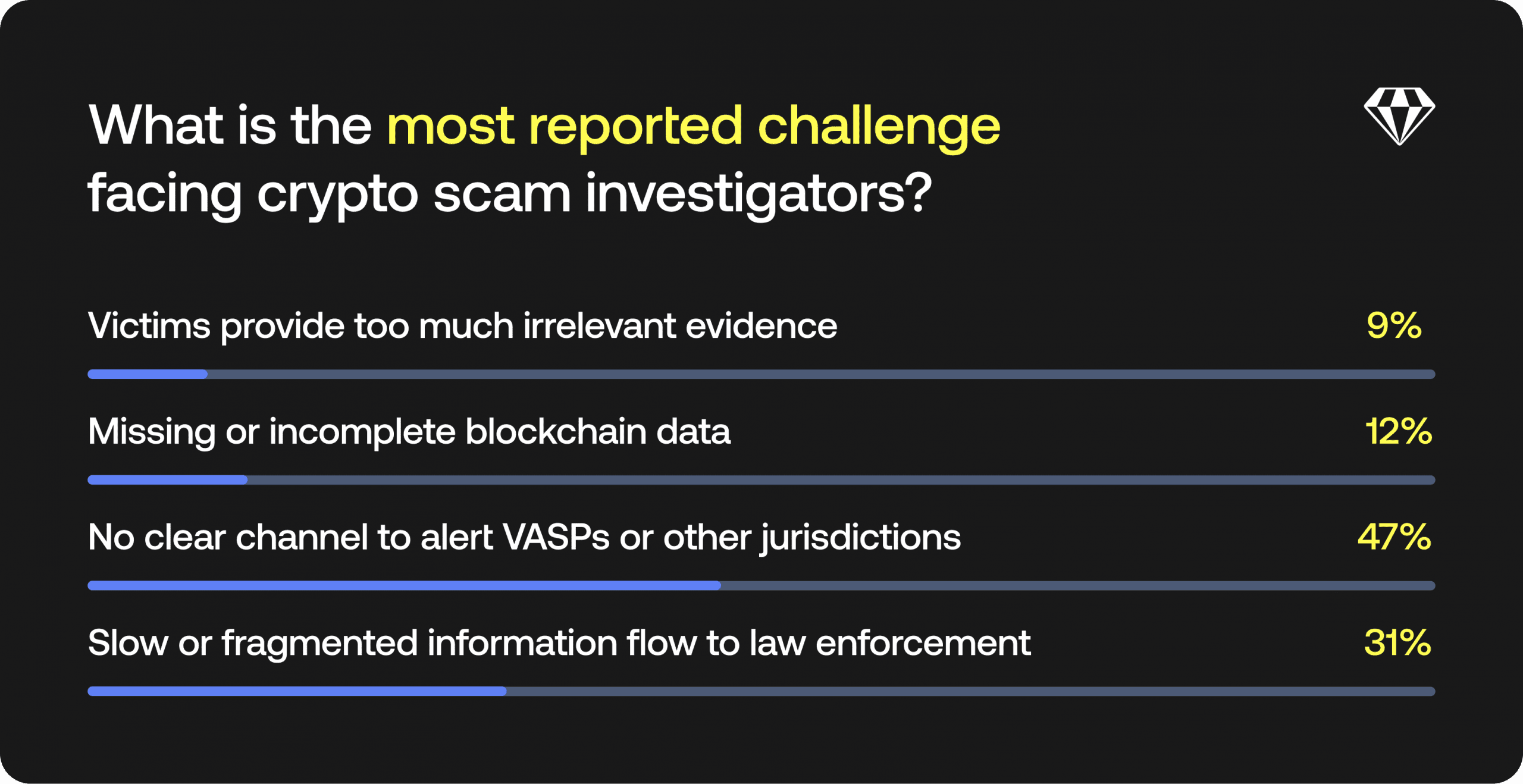

Above: Our second poll uncovered that 47% of the audience indicated there are no clear channels to alert VASPs or other jurisdictions.

The mental state of crypto fraud victims

Anyone can be scammed – from vulnerable populations to sophisticated professionals. Victims are often in a stream-of-consciousness state when reporting, making structured information gathering difficult. However, this unfiltered initial account can be valuable before memories fade and autocorrection sets in.

The crypto fraud reporting gap faced by investigators

Whether due to shame or ignorance, most victims fail to report within the 48-hour window, and fraud can go unnoticed for weeks, months, or years. This is frequently too late for effective retrieval action to be undertaken.

The jurisdictional challenges faced by Virtual Asset Service Providers (VASPs)

Regardless of their efforts to help victims, VASPs are hampered by cross-border crypto fraud activities. They might operate in one jurisdiction, while victims are in another, and perpetrators in yet another. Further stifling of investigative efforts is often because wealthier nations prioritize protecting their own citizens, while developing countries lack the necessary resources. Additionally, some jurisdictions, such as Nigeria, India, and Romania, are unresponsive or slow to assist, possibly due to a lack of will.

Sam noted that the United Nations is addressing inadequate international cooperation by developing projects that will create official crypto ecosystems, linking victims, law enforcement officials, and VASPs worldwide, and mandating reporting systems to improve cross-border intelligence sharing, regardless of countries’ economic status.

Introducing the Scam Alert: empowering victims through technology

The panel emphasized that no blame should be attributed to victims, as scams often involve highly sophisticated criminal activity. While collecting necessary documentation from victims, investigators should also offer emotional reassurance- a “metaphorical hug”- to the victims, cognizant that they are traumatized, not merely robbed.

With this principle in mind, Crystal Intelligence has developed Scam Alert to bridge the gap between victims and investigators:

Scam Alert offers a user-friendly questionnaire that categorizes reports into four key areas (fraud, theft, malware, and extortion) and is organized by the levels of importance to victims, not just investigators. It guides complainants through the reporting process.

The data is enriched with Crystal Intelligence’s existing information, and 2 to 3-page PDF reports are generated, formatted for professional investigators.

The process:

- Victims answer straightforward questions

- The system categorizes the scam type

- Information is organized by investigation priority

- PDF report is created in investigator-ready format

- Victims receive guidance on the appropriate local authorities to contact

Backend investigation tools

The platform provides investigators with:

- Access to an anonymized database

- Clustering techniques to build scammer profiles

- Identification of payment networks and wallet address patterns

- Mapping of fund movements and cash-out points

- Tracking of sanctioned country exchanges

The power of data aggregation

Scammers frequently change cryptocurrency wallet addresses between payments. Aggregating victim reports enables:

- Interruption of scams mid-stream

- Cross-referencing of addresses from different frauds

- Follow-up questions to victims about related addresses

- Linking multiple victims to the same criminal operations

- Building comprehensive cases that meet prosecution thresholds

Best practices and final recommendations for how the industry can tackle crypto fraud

For those supporting victims

Mark Fetterhoff emphasizes meeting victims where they are in their situation, recognizing that victimization varies for each individual.

Sometimes, simply listening for 20 minutes can serve as the most effective therapy, as it’s not just a financial transaction but a personal trauma. Making victims feel heard can sometimes be more important than recovering funds.

Wendy Langridge’s guidance for victims emphasizes the importance of remaining vigilant against unsolicited calls, texts, and emails, especially those claiming to assist with recovering lost money.

She advises seeking emotional support by confiding in someone trusted and reminds individuals that scammers are highly skilled criminals who exploit human psychology. She emphasizes that falling victim to scams does not reflect a lack of intelligence and that there is no shame in coming forward. Reporting these incidents is crucial, as it helps authorities apprehend criminals.

For potential victims

Sam Rogers says that anyone can fall victim to scams, even so-called experts.

It’s important to keep reporting incidents, regardless of a country’s response rate. Without reports, there is no chance of action being taken. He also recommends that encouraging family and friends report any suspicious activity. Persistence in reporting will eventually help close the door to scammers.

The webinar emphasized that combating cryptocurrency fraud requires a multi-faceted approach:

- Technology solutions like Scam Alert to streamline reporting and investigation

- Human compassion in supporting victims through trauma

- Data aggregation to identify patterns and criminal networks

- International cooperation to overcome jurisdictional barriers

- Community awareness to reduce stigma and encourage reporting

Most importantly, victims must understand they are not alone. The sophistication of modern scams means anyone can fall victim. By reporting, sharing information, and supporting one another, the community can work toward a future where these criminals face meaningful consequences for their actions.

The fight against cryptocurrency fraud is only beginning. Still, with platforms like Scam Alert and continued collaboration between victims, investigators, compliance professionals, and law enforcement, there is hope for progress in protecting vulnerable individuals and bringing perpetrators to justice.

Watch the full discussion