Gaming and gambling are among the most popular forms of entertainment around the world. The rise of these two industries has been particularly accelerated in the 21st century.

Historically, participants involved in gaming and gambling activities relied upon traditional currencies to make purchases. However, this scenario began to change during the early 2000s, when virtual currencies made their way into gaming and gambling.

South Korea was the first country where players were allowed to make micro-purchases within video games. This was in 2003 when a game developer known as Nexon enabled digital transactions in one of their game titles. This step went a long way in ensuring that digital transactions became a norm within gaming and gambling. By the mid-2010s, cryptocurrencies such as Bitcoin had become an important part of video games and gambling activities. And the COVID-19 pandemic has seen the use of cryptocurrencies in gaming only increase further.

Despite this growth, regulating cryptos in gaming and gambling can be tricky. It can be hard to track cryptocurrencies being sourced from questionable or suspect sources. Further, the use of online gambling sites in jurisdictions where they are banned is also becoming common. Therefore, the crypto and gaming industries must look to be proactive in ensuring compliance.

This article looks at ways in which firms can de-risk the use of cryptos in gaming and gambling.

Rising Use of Cryptos in Gambling

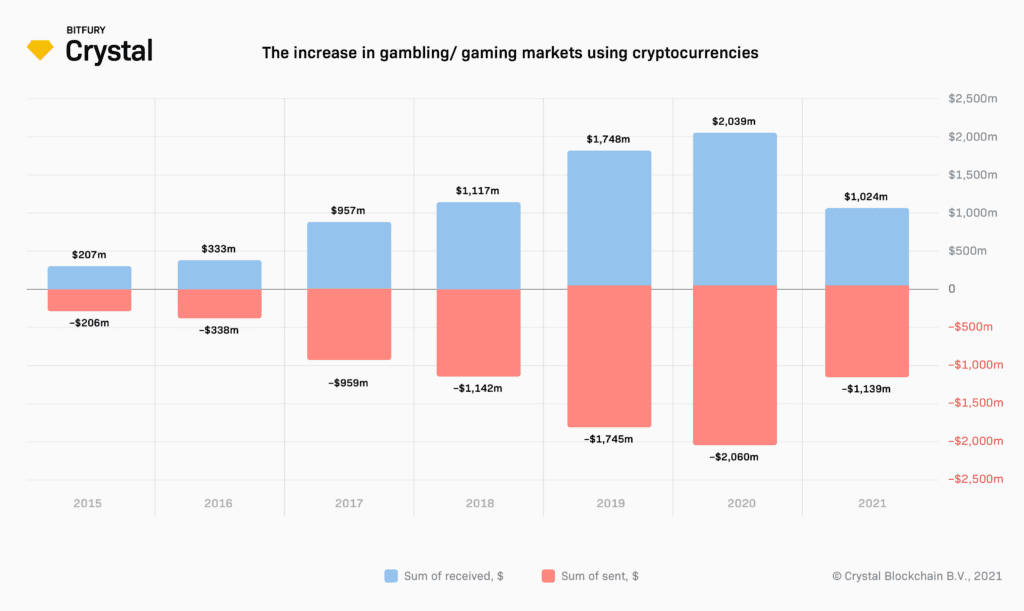

As seen in the graphs below, the amount of crypto being sent and received within the gambling market has shown an uptick in recent years. The data compiled by Crystal Blockchain below indicates that the total amount of crypto sent in gambling during 2020 stood at $2.04 billion, which indicates a 16.6% increase over 2019. Similarly, the total amount of cryptocurrencies received in gambling during 2020 stood at $2.06 billion, an 18% increase over 2019.

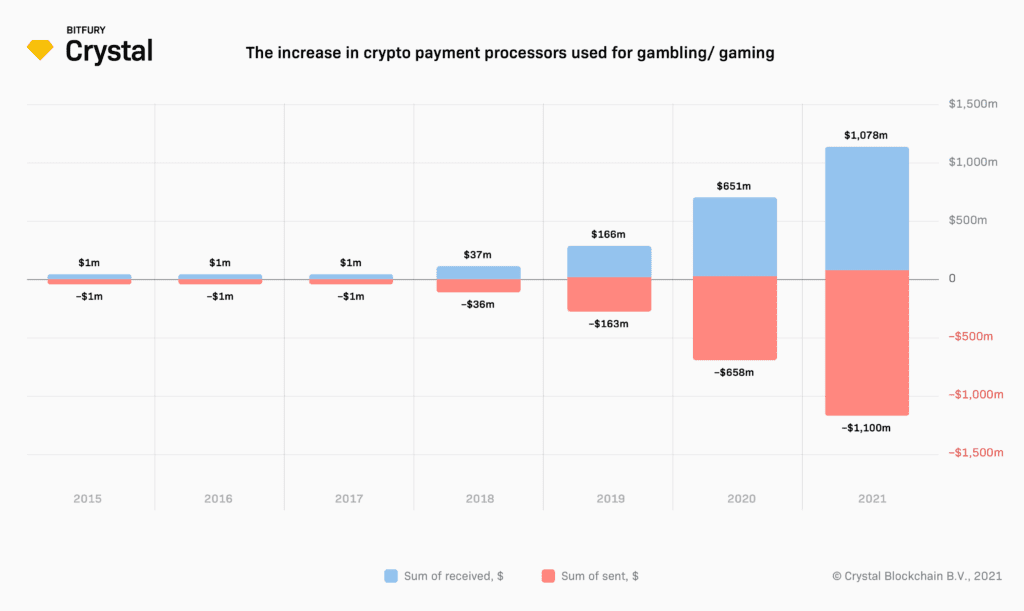

The number of gaming and gambling marketplaces that use payment processors is also on the rise. In 2021, the total value of cryptocurrencies sent via such processors increased by 65.6%.

A primary reason behind this growth has been the COVID-19 pandemic. This pandemic created a situation where people cannot step out of their homes and resort to alternative forms of entertainment such as gaming and gambling online. To cater to the increased demand, gaming and gambling marketplaces are making use of crypto payment processors – since they understand the crypto market better and can process crypto payments more efficiently.

Cryptoprocessing by CoinsPaid – the gateway payment processor

IMAGE: From Cryptoprocessing by CoinsPaid

One of the most popular payment processors for crypto in online gambling is Cryptoprocessing by CoinsPaid. CoinsPaid provides a trusted payment gateway that enables gaming and gambling firms to accept crypto payments.Aside from gambling and gaming, the payment processor also serves several other industries and businesses such as eCommerce, eSports, marketing, and software development companies. The benefit of using Cryptoprocessing is it allows these companies to reduce costs, enter new markets, and achieve full compliance.

CoinsPaid has observed that the overall gaming market is becoming highly receptive to crypto payments. It has already become the number one payment provider within the iGaming space. CoinsPaid estimates that the share of crypto payments in gaming during Q1 2020 was just 6%, and this increased to as much as 26% by Q1 2021. To make the most of this opportunity, CoinsPaid has launched its crypto processing products. CoinsPaid uses Crystal’s analytics platform for its transactional risk management and AML compliance due diligence procedures.

Mark Krupyshev, the CEO of Coinspaid, stated, “At CoinsPaid, we use Crystal analytics platform for transactional risk management and compliance. We understand the importance of having quality AML due diligence procedures in place for payments, and our collaboration with our partners at Crystal is a key part of that. Crypto use in gambling and gaming markets is on the increase, and we want to be part of the solution to make the gaming and crypto space safer”.

Why your marketplace needs to get compliant

Gambling has always been a controversial industry due to its very nature. However, it has also been a well-regulated industry as a result. For example, in countries like the US, multiple federal-level and state-level regulations govern this industry. Therefore, gaming and gambling marketplaces need to comply with these regulations fully. Similarly, other countries such as Japan have also developed comprehensive regulations that govern the gambling industry.

While the country has formulated blanket regulations for gambling, there is some ambiguity related to aspects such as casino gaming. Thus, leading gaming and gambling marketplaces in the country must be extremely careful and ensure that they are not breaking any rules and regulations. Regulations cannot be ignored – your customers will demand full compliance. Fully compliant marketplaces that are ready for customers will be able to capture the market quickly.

What can you do to be compliant?

The best way for gaming and gambling marketplaces utilizing crypto to be fully compliant is to ensure that they avoid common crypto compliance pitfalls. For instance, they should ensure that they are fully trained about the nuances of the cryptocurrency/ blockchain industry. Similarly, they must also make sure that all their policies are updated on time. Finally, such marketplaces must also customize their monitoring activities and keep an eye out for suspicious entities.

Gaming marketplaces also need to conduct comprehensive risk assessment studies from time to time. They need to pay heed to historical data in order to identify suspicious transaction trends. Marketplaces that follow the above steps will be better positioned to ensure full compliance. These firms can also seek advice from compliance experts such as Crystal.

A commitment to derisking crypto

There is a potential risk in gambling and gaming using crypto because such digital assets are still being regulated. However, by using the correct analytics tools to combat that risk – such dangers can be mitigated, and full compliance can be achieved. Crystal Blockchain and CoinsPaid are committed to making this space safer even before the regulators get involved.

To learn how Crystal can help you transform your compliance processes, book a call with us here.