Understanding crypto usage in MENA requires abandoning Western compliance frameworks. Crystal Intelligence’s latest webinar revealed how crypto risk in the Gulf differs fundamentally from global patterns—and why that matters for your compliance program.

Led by Chief Intelligence Officer Nick Smart, and Content Director, Nicolette Brown, this deep dive into the six Gulf Cooperation Council (GCC) countries uncovered critical insights that generic risk models miss entirely.

Key takeaways: MENA crypto risk at a glance

Before diving deeper, here’s what you need to know:

- Iran: 21 million active crypto users (20% of population)

- Oman P2P markets: Nearly $3 million in daily transaction volume

- 1.4% of Iran’s annual GDP flows through cryptocurrency

- Mobile payment methods and gift cards create new compliance blind spots

- Traditional hawala networks are integrating with crypto infrastructure

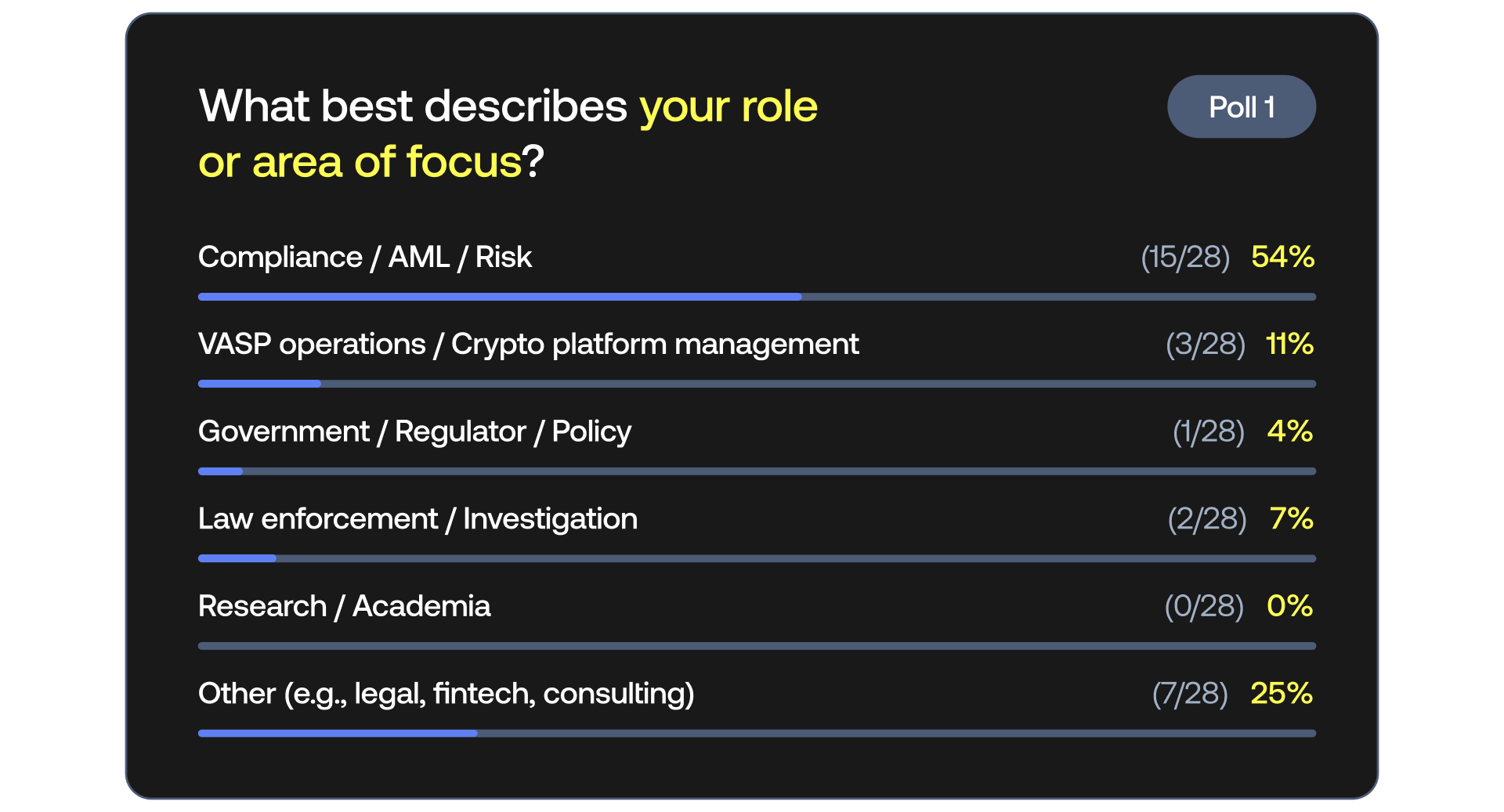

Crystal ran a series of polls during the webinar, the first to learn who the audience is:

Poll#1: A full 79% came from business and compliance, with law enforcement, civil servants and making up just 22%, while academic researchers didn’t attend.

Why Crypto Risk in MENA differs from global markets

The GCC countries were chosen due to the contrast between their geopolitical/commercial links and significant differences in crypto regulatory positions.

Several key crypto usage drivers were identified:

- There are widespread international commercial hubs, such as the UAE, where buyers and sellers seek to trade in a universal currency, such as crypto, rather than a local one.

- Large numbers of expatriate workers are remitting money to their home countries, and crypto is growing in popularity as a means of doing so.

- Economic instability and inflation in neighboring countries such as Egypt and Lebanon.

- Differing regulatory attitudes, from the UAE’s progressive approach to Kuwait’s outright ban.

Expanding on the latter point, Nick highlighted the difference between the UAE, which has adopted a detailed regulatory environment through the Virtual Assets Regulatory Authority (VARA) promoting innovation with oversight, and Kuwait, which has a total crypto ban.

The problem with generic compliance models

Nick emphasized the need for local risk assessments rather than relying on generic models developed for North American or European societal frameworks. For compliance in MENA countries to be practical, local criminal and fraud activities and the economic realities of the countries’ inhabitants must be considered.

“A lot of people go to big, generic reports that talk about generic typologies that aren’t necessarily focused on one specific country. But let’s say I’m opening a business inside Algeria, do I understand what the specific risk vectors are in Algeria? Do my compliance team understand what fraud looks like there? Do I understand the typologies and the patterns?”

Such insights are critical when operating in regions underreported by Western, often English-language media. This approach to understanding crypto risk in MENA goes beyond traditional on-chain analysis.

Crystal emphasizes the need to focus not only on on-chain activities, but also on off-chain realities such as local trading behaviours, social media usage and informal cash networks, which significantly shape MENA’s crypto markets.

Nick highlighted the need to go beyond the usual focus on terror financing or sanctions evasion to understand everyday activities such as remittance methods or inflation hedging.

He used Iran as an example, with approximately 21 million active crypto users, about 20% of the population, and an estimated 1.4% of GDP flowing through crypto. However, this activity is often invisible to on-chain analysis as it occurs through domestic exchanges and informal peer-to-peer networks.

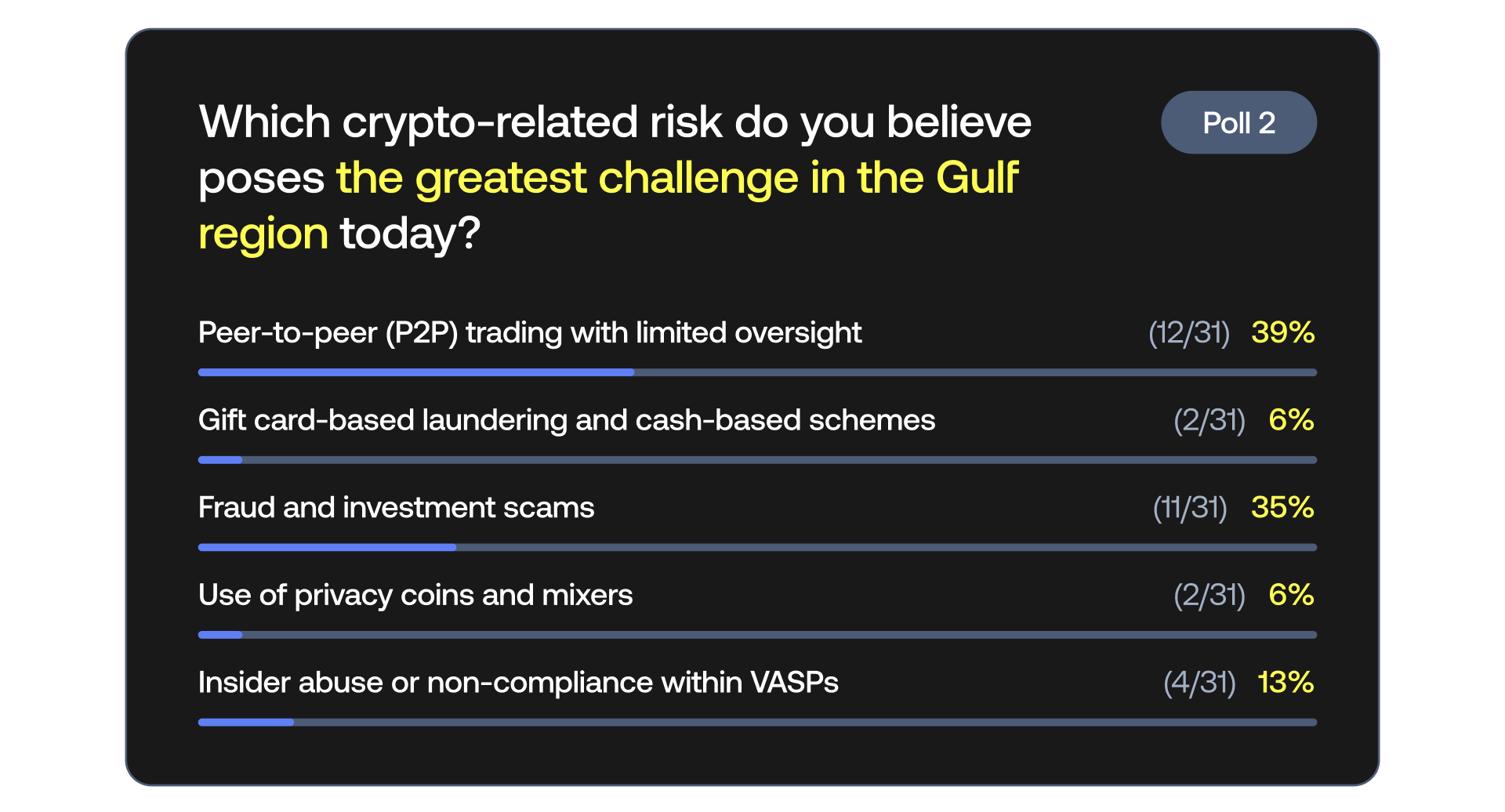

Poll#2: 74% of our respondents saw fraud and unchecked Peer-to-peer trading platforms as a challenge, 13% saw risks of insider abuse and non-compliance with VASPs, and 6% each saw laundering risks in gift cards and using privacy coins and mixers.

Understanding Peer-to-Peer Risk in the Gulf

The explosive growth of peer-to-peer risk was demonstrated by highlighting Oman, where usage platforms such as Binance and OKX rapidly expanded. In the seven months until January 2025, the number of Omani Rial crypto adverts (buying and selling) increased significantly, with daily transaction volumes on Binance peer-to-peer nearing $3m.

But here’s what makes peer-to-peer risk in MENA unique: The settlement methods tell the real story. Ads show payment options including bank transfers, but increasingly mobile payment methods like Vodafone Pay and e-Money, plus gift cards—all creating blind spots for traditional financial institutions, who may not realize they’re processing crypto-related transactions.

How OTC Desks in MENA Operate Differently

While Western markets rely heavily on regulated exchanges, OTC desks in MENA serve a crucial role beyond simple large-volume trading. These desks act as bridges between traditional financial systems and the crypto economy, often integrating with established informal networks.

What makes OTC desks in MENA unique is their frequent interface with hawala networks, blending centuries-old trust systems with blockchain technology. Many operate in regulatory grey areas while processing millions in daily volume, serving institutional clients who need to move large amounts without impacting market prices.

Understanding how OTC desks in MENA function is essential for any compliance program—they require region-specific monitoring approaches that generic solutions miss.

Real fraud patterns: gift cards and mobile payments

While initially created to promote financial inclusion in underbanked communities, these systems can be vectors for fraud and regulatory evasion. Both payment methods are now used for crypto transactions to bypass banking restrictions.

Gift cards, often sold on informal networks, are bought with fiat currencies and later redeemed as crypto. This challenges financial institutions to understand who made the purchase originally.

Mobile payment systems such as Vodafone Pay and e-Money enable users to make crypto purchases indirectly, thus hiding the real purpose of transactions from legal financial institutions.

Nick Smart explained the transaction flow:

The buyer will:

- Buy credit for their mobile using a normal payment gateway

- Contact the seller to arrange a trade

- Provide their cryptocurrency wallet address

- Send mobile money to the seller

- Receive cryptocurrency in return

Economic Hardship and AI-Enabled Fraud

Nick pointed to the relationship between economic hardship and susceptibility to fraud and scams, particularly in inflation-hit countries such as Egypt, Lebanon and Iran. Artificial Intelligence (AI) has become a significant enabler of fraud, allowing criminals to scale their operations and tailor messages for specific demographics, using victims’ local and other languages. He gave several examples:

- Localized scams using AI-enhanced communications are used to deceive victims.

- Large-scale investment scams in Kuwait have caused victims to lose millions of dollars.

- Many fraudsters exploit public interest in get-rich-quick schemes via crypto.

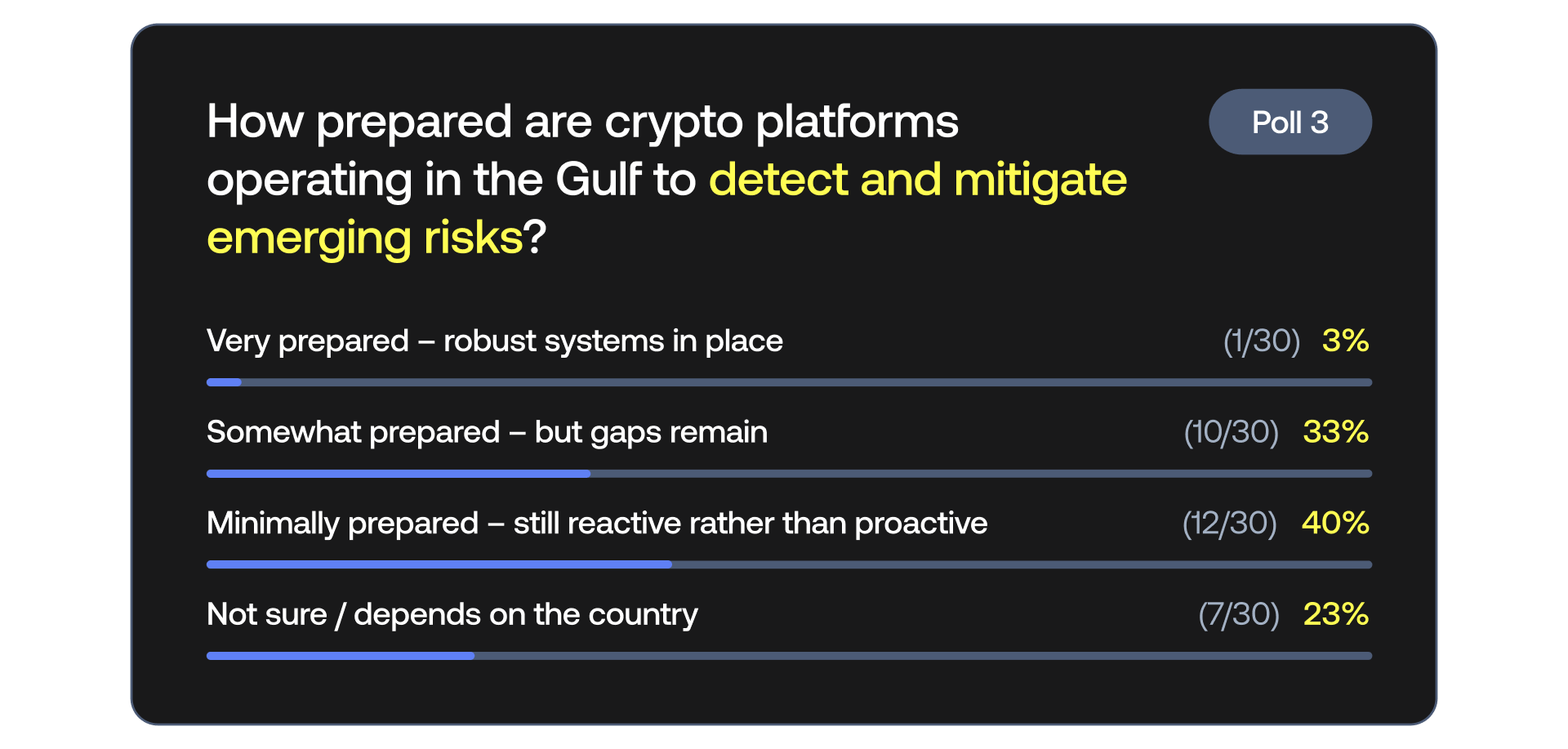

Poll#3: Just 3% were fully prepared, 23% were uncertain, and a full 73% were only ‘somewhat’ or ‘minimally’ prepared.

MENA’s regulatory spectrum: from VARA to total bans

The workshop examined the range of regulatory approaches in the region, and Nick highlighted a selection:

- In the UAE, the VARA issues detailed rulebooks and runs several crypto-specific digital sandboxes.

- Kuwait has an outright ban, but this position reflects caution rather than outright hostility, what Nick Smart referred to as a ‘wait-and-see’ approach.

- While not a MENA example, Pakistan’s recent definite shifts towards engagement with crypto regulation, from an initial position of stern opposition.

Outright bans have driven activity underground with all the many criminal risks involved. The workshop concluded that a more suitable approach would be a phased regulatory model, starting with a regulatory framework, observing its impact, then proceeding to enforcement and tax structures.

Integrating crypto regulation with traditional systems

Traditional informal value transfer systems, such as Hawala, a trust-based payment system via informal agents, are now moving to crypto, especially in South Asia and the Gulf. These well-established networksoperate outside formal banking systems.

Nick suggested that, rather than criminalizing these systems, regulators consider the following steps to gain information rather than forcing activity further underground:

- Licensing and supervising these networks and opening taxation and job creation opportunities.

- Introducing KYC and reporting requirements.

- Leveraging them to improve the visibility of crypto flows.

“The reality is a progressive regulator could look at it and say, ‘We can’t stop them,but we need to supervise them. We need to see what they’re doing. We need to give them access to blockchain intelligence tools.”

Regional comparisons: MENA and APAC

In examining the MENA region’s unique cultural dynamics, Crystal has identified many patterns that mirror those in the Asia Pacific Region (APAC), where the company has also conducted extensive research. Because of crypto’s borderless nature, risks in one area become risks globally, meaning that fraud and scams in one area can migrate to, or be replicated in, other areas.

Some key parallels of MENA with APAC are:

- Tourism-related crypto usage.

- A rising number of crypto ATMs and in-person exchanges in APAC, versus fewer in MENA.

- Illegal cash desks in Thailand and Cambodia are currently the focus of enforcement efforts.

What this means for your compliance program

If these findings reveal gaps in your current approach, you’re not alone. Our polling showed many platforms feel only “minimally prepared” for emerging MENA risks.

Here’s how to strengthen your program:

- Abandon generic risk frameworks. Stop relying solely on Western-centric models. You need intelligence specific to each country where you operate.

- Understand local payment methods. From mobile money to gift cards, alternative payment channels are integral to crypto usage in MENA. Your monitoring must account for these.

- Map the off-chain ecosystem. On-chain analytics tell only half the story. Understanding social media channels, local forums, and cash desk operations is equally critical.

- Prepare for regulatory evolution. Today’s ban might be tomorrow’s framework. Stay informed as countries like Pakistan make dramatic U-turns on crypto policy.

The bottom line: cryptocurrency has a national flavor

Nick’s closing message was clear: “cryptocurrency is a global product, but it has a national flavor.”

Key recommendations were:

- Stop using generic, Western-centric risk frameworks in favor of country-specific risk assessments.

- Develop regional partnerships with local experts and intelligence providers.

- Learn to treat crypto as part of broad financial inclusion and digital transformation, particularly where access to traditional banking is limited.

For compliance teams, understanding crypto usage in MENA means accepting that the fraud patterns in Kuwait differ from those in the UAE. The P2P markets in Oman operate differently than those in Saudi Arabia. And the traditional financial networks that crypto intersects with vary dramatically across the region.

Conclusion

The webinar concluded with a clear call to action for crypto regulators and businesses to move beyond simplistic, formulaic narratives. At the intersection of economic volatility, informal networks and regulatory gaps, crypto risk in MENA presents unique challenges and great opportunities when approached with insight.

By investing in good regional and cultural understanding and instituting nuanced controls, the crypto ecosystem can grow more safely and inclusively, without leaving blind spots for criminal bad actors to exploit.

Ready to navigate crypto risk in MENA with confidence?

Generic solutions miss the regional patterns that matter most. See how Crystal’s transaction monitoring platform built on deep regional intelligence identifies the risks others miss.