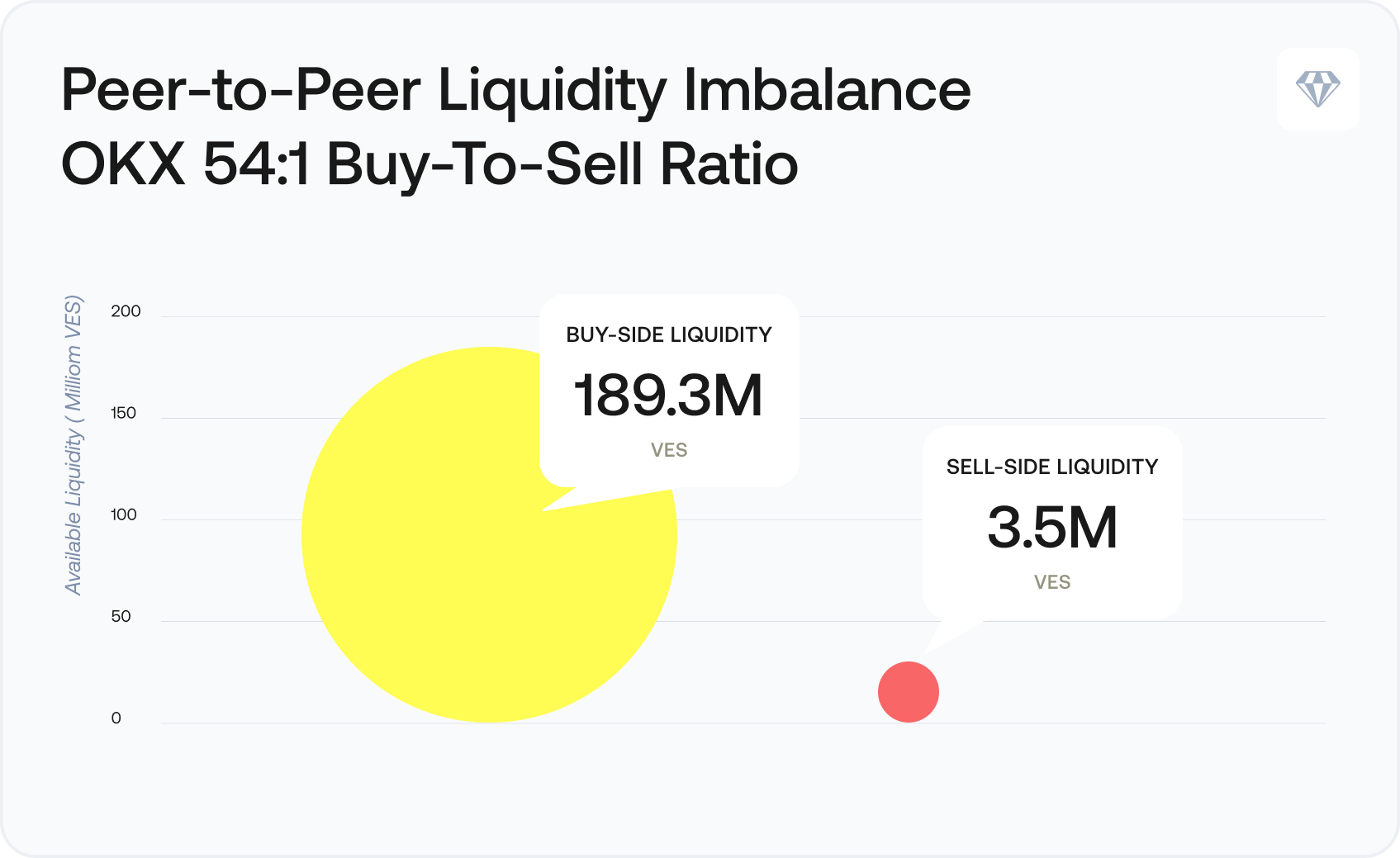

When US forces captured President Maduro on January 3, 2026, Venezuela’s peer-to-peer crypto markets came under immediate stress. Within days, buy-side demand overwhelmed sell-side liquidity by ratios as extreme as 54:1. People needed to move money fast-and what had been theoretical peer-to-peer (P2P) crypto compliance risk became urgent.

Crystal Intelligence analyzed $20.8M in P2P crypto advertised for trade across seven major exchanges during January 7-9, 2026. The data revealed structural vulnerabilities that exist in P2P markets worldwide, not just during crises.

The core problem: operators running institutional-scale volumes within compliance frameworks designed for casual retail activity. The gap between how these markets actually function and how they’re monitored creates exposure that most exchanges haven’t addressed.

Institutional operations hiding in retail frameworks

Most P2P compliance frameworks assume small-scale activity: individuals trading modest amounts of USDT through classified-ad-style platforms. The Venezuela data tells a different story.

We identified merchants advertising positions at up to $99,000 per listing. These aren’t hobbyists. One operator had completed over 11,000 lifetime transactions with a 95%+ completion rate. Another maintained positions worth tens of millions in Venezuelan bolívars while serving as a primary liquidity source for an entire platform.

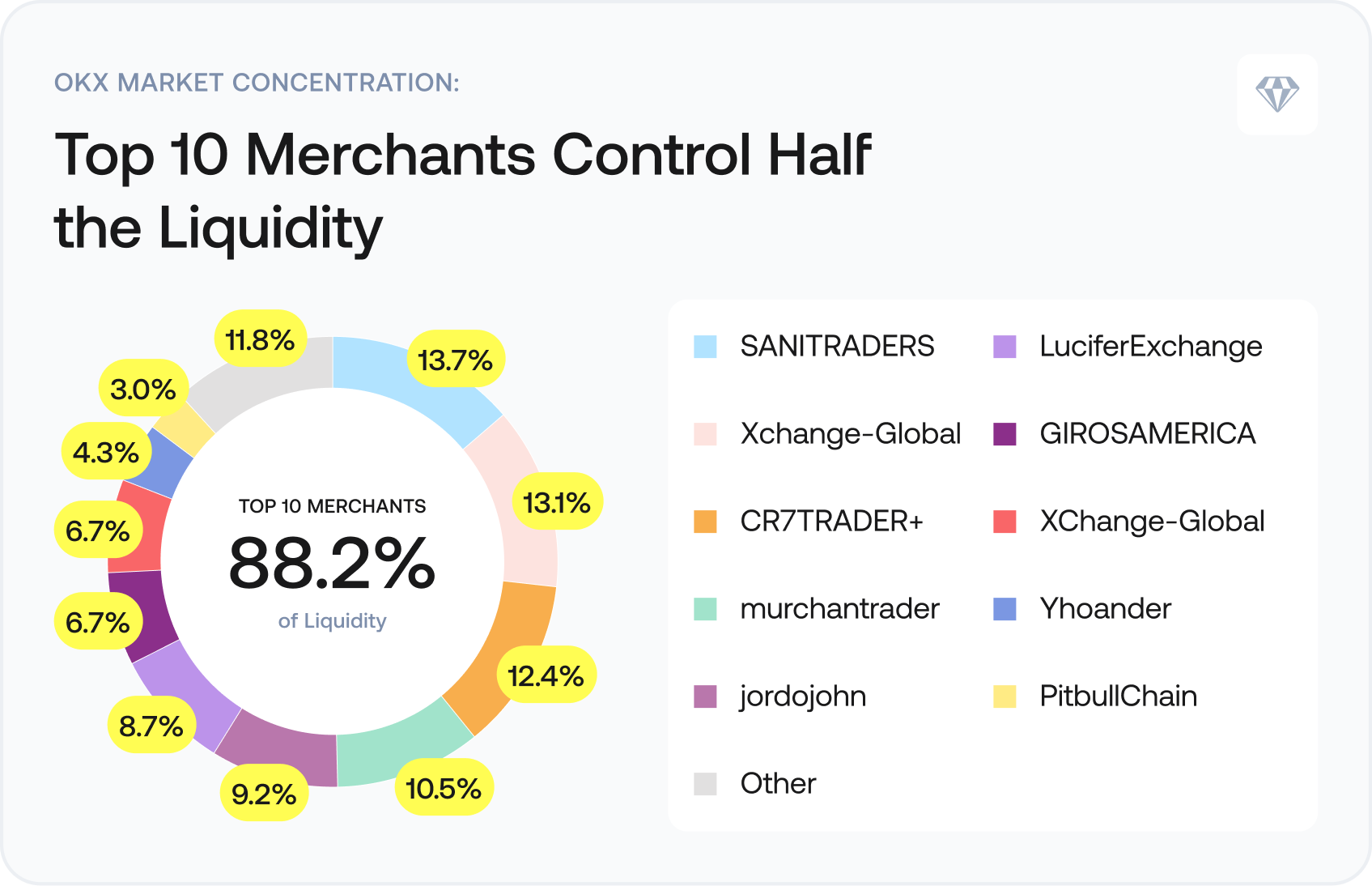

On OKX, just 32 merchants provided all buy-side liquidity for Venezuelan bolívar-to-USDT trades. The top 10 controlled 88% of available liquidity. The single largest merchant held 13.7% of the market.

These operators process volumes that would trigger enhanced due diligence on any centralized exchange. But within P2P frameworks, typically built around retail-focused KYC requirements and thresholds calibrated for small amounts, they often operate below the monitoring radar.

Figure 1: OKX Market Concentration in Brazil, January 2026

Where the compliance gaps emerge

The data identified three primary gaps:

Scale mismatch

A merchant processing $99,000 in positions with thousands of completed orders is operating a de facto money services business. Yet P2P frameworks often apply the same oversight to someone selling $50 of crypto to a friend. Monitoring designed for casual traders doesn’t catch institutional-scale activity.

Off-platform settlement

Exchanges verify user identity, but the fiat side of each trade settles outside their supervision. A merchant receives USDT on-platform but completes the bolívar payment through local banking rails. The exchange sees the crypto movement but has limited visibility into the fiat flows including their source, their destination, or whether they involve sanctioned parties.

Sanctions exposure

Venezuela carries a significant risk under the US OFAC programs. Institutional-scale operators facilitating bolívar-to-USDT conversion are effectively providing currency exchange services in a sanctioned jurisdiction. If sanctioned entities or government actors use these channels, exchanges hosting the platforms face regulatory consequences. “We categorized it as retail P2P” won’t satisfy enforcement authorities.

Concentration creates systemic vulnerability

The Venezuela data showed extreme concentration at multiple levels:

- Market level. One dominant platform captured over 85% of total regional P2P liquidity. When a single venue controls that share, regulatory action or technical issues affect the entire ecosystem.

- Platform level. On OKX, 10 merchants controlling 88% of liquidity means those operators aren’t just users; they’re infrastructure. Sanctions against one, operational issues with another, or competitive offers that pull away a third can quickly collapse market liquidity.

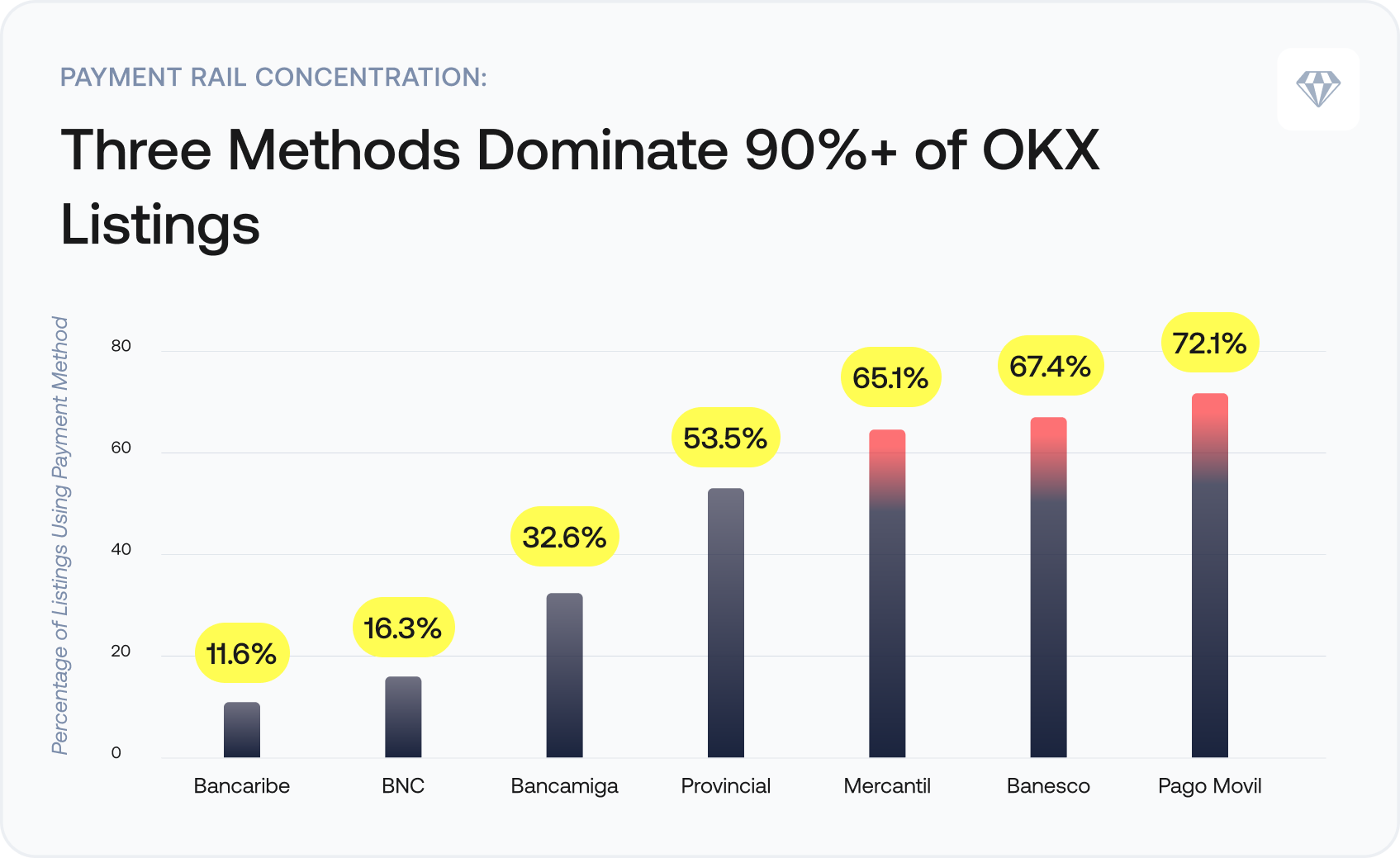

- Payment rail level. Three methods dominated fiat settlement: Pago Movil (72% of listings), Banesco (67%), and Mercantil (65%). If any faces sanctions, technical disruption, or government intervention, most P2P activity loses functionality.

Figure 2: Payment Method Concentration

Concentrated payment rails mean concentrated exposure. If illicit activity flows through these channels, the problem is systemic rather than dispersed. But the same concentration creates monitoring efficiency-if compliance teams recognize the pattern and act on it.

Crisis behavior as a compliance signal

The January crisis functioned as a stress test, making visible patterns that remain hidden during normal operations.

Buy-side liquidity exceeded sell-side by 54:1 on OKX. People urgently wanted to convert bolívars to USDT; almost no one wanted the reverse. Classic capital flight.

Figure 3: Use case –liquidity Imbalance demonstrated by OKX’s buy-to-sell ratio

For compliance teams, extreme imbalances are signals. Sudden directional shifts in P2P markets correlate with political instability, currency crises, and capital controls—exactly the conditions that elevate sanctions evasion and money laundering risk. Platforms monitoring for these patterns can escalate oversight when it matters most.

What exchanges should do

The analysis points to five areas requiring attention:

- Tiered oversight by scale. Set thresholds where P2P positions or activity trigger enhanced due diligence. Merchants advertising $10,000+ positions warrant institutional-level scrutiny: sanctions screening, activity monitoring, enhanced identity verification.

- Concentration monitoring. Track liquidity distribution across top merchants. When 10 operators provide 88% of your market, they represent systemic risk if compromised.

- Payment rail mapping. Know which methods handle your P2P fiat settlement and how concentrated usage is. Rails handling 90% of transactions need sanctions screening and ongoing monitoring.

- Liquidity imbalance alerts. Build monitoring that flags abnormal buy-sell ratios. A 54:1 ratio isn’t just a market statistic—it’s a compliance early warning.

- Crisis scenario planning. Model what happens if a jurisdiction faces political upheaval or new sanctions. Which merchants need rapid off-boarding? Which payment rails might become prohibited?

The bottom line

P2P markets have evolved beyond the retail activity that compliance frameworks assumed. When merchants operate $99,000 positions, when platforms depend on 32 merchants for all liquidity, and when 90% of transactions flow through three payment rails, you’re looking at institutional-scale infrastructure in high-risk jurisdictions.

That warrants institutional-level monitoring. Exchanges that recognize this can build compliance frameworks matching operational reality. Those treating P2P as low-priority retail activity face growing exposure as volumes scale and regulatory scrutiny intensifies.

Venezuela’s crisis made these patterns visible. The vulnerabilities exist in P2P markets globally.

FAQs

What is P2P crypto compliance risk?

The regulatory exposure exchanges face when peer-to-peer platforms host institutional-scale operations within retail monitoring frameworks—creating gaps in KYC, transaction monitoring, and sanctions screening.

Why is Venezuela P2P high-risk?

Venezuela is subject to US OFAC sanctions. P2P platforms facilitating bolívar-to-USDT trades effectively provide currency exchange services in a sanctioned jurisdiction.

How can exchanges reduce P2P compliance risk?

Through tiered oversight based on merchant scale, concentration monitoring, payment rail mapping with sanctions screening, liquidity imbalance alerts, and crisis scenario planning.

Crystal Intelligence helps exchanges identify P2P compliance risk-from screening high-volume merchants against sanctions lists to mapping payment rail dependencies.