by Nick Smart, Director of Blockchain Intelligence

This report has been written to provide businesses, regulators, and law enforcement agencies with a comprehensive analysis of the cryptocurrency landscape in Taiwan.

It focuses on cryptocurrency acquisition, usage, and service providers within the market, offering valuable insights into the region’s crypto risk profile, and the regulatory infrastructure which Taiwan’s financial authorities have developed to govern it.

We examine how individuals in Taiwan access and use crypto assets, identify the prominent service providers facilitating these transactions, and explore the broader adoption of cryptocurrencies across the country.

Since its cautious beginning in 2013, Taiwan’s cryptocurrency market has seen initial hesitance, followed by steady growth, and then an accelerated expansion in 2023 and 2024, driven by a stronger regulatory framework.

Today, multiple exchanges are regulated by the Taiwan Financial Supervisory Commission (FSC), reflecting the country’s commitment to ensuring a secure and compliant crypto environment.

However, the flourishing crypto market has also seen a downside, with crypto-related fraud being a growing problem.

See how crypto fraud trends in Taiwan compare with global ones by looking at our hacks and scams report here.

In Taiwan, crypto assets are generally purchased through centralized exchanges. However, a similar and large network of over-the-counter (OTC) services and peer-to-peer (P2P) exchanges, including social media offers, ATMs, and even e-commerce websites, also exist.

In Taiwan, local virtual currency exchanges have specific regional characteristics, which can be seen in the following areas:

Moreover, Tether (USDT) is the largest stablecoin in Taiwan in terms of market capitalization. It’s worth noting that all surveyed platforms support BTC, ETH, and USDT.

We found that most platforms offered fiat support and a UAE Dirham / Russian Rouble (AED/RUB) currency pairing. Many also allowed the exchange of RUB.

We identified several Crypto Asset Service Providers (CASPs) with an online presence that offer services to users in Taiwan. Additional services related to informal money transfers may also be available on platforms like Telegram, Instagram, or LINE.

Additionally, there are several physical cryptocurrency trading counters in Taiwan.

A centralized exchange is a platform owned and operated by a single party and is subject to local legislative requirements. It serves as an intermediary between buyers and sellers, provides liquidity for trading with other users, and safeguards clients’ funds.

The Taiwan FSC has regulated several centralized cryptocurrency exchanges in the country. They also have offices in the UK and US, the details of which are included below:

Taiwan Office

18F., No.7, Sec. 2, Xianmin Blvd., Banqiao Dist., New Taipei City 220232, Taiwan(R.O.C.)

TEL:886-2-8968-0899

London, United Kingdom Office

Level 17, 99 Bishopsgate, London EC2M 3XD, United Kingdom

TEL:(44-20)7628-1501

New York, United States Office

1 E.42 Street, 13F, New York, NY 10017, U.S.A

TEL:(1-212) 317-7326

For a complete list of regulated exchanges, contact us here.

Over-the-counter trading services, also known as OTC desks, are typically used for executing large orders.

Instead of placing a big buy or sell order on a public exchange, which could take time to complete, cause a market disturbance, or be filled in parts, risking price changes, an OTC desk can handle the order and take on the risk of price fluctuations. This service usually charges higher fees.

Aside from these legitimate uses, OTC Desks provide other advantages that may be attractive to illegal activity:

The term OTC Desk is often misunderstood to mean any business that offers an in-person sale or purchase of cryptocurrencies.

OTC Desks rely on several channels to attract and service clients, including:

“Cash for crypto” OTC crypto asset trading services

Unlike the more established, traditional, regulated trading desks, many so-called “Cash for Crypto” OTC trading services are unregistered. They neglect to perform even cursory background checks and consequently represent a significant risk for money laundering.

That is not to say they cannot be investigated. They require a fiat off-ramp, and many operators lack the technical skills to run a self-custody exchange. To that end, many operate using their own accounts on larger service providers, acting as so-called “nested” or “parasite” exchanges.

OTC crypto asset services offered by centralized exchanges

OTC crypto asset services offered through social media

Many groups offer support for USDT in Taiwan over other currencies, such as Bitcoin.

Numerous services are advertised via Line, a popular messaging application with users in East and Southeast Asia.

A simple search for ‘USDT’ and ‘Taiwan’ in Latin and Chinese characters will return many results.

>> For a list of the top channels we could detect offering USDT trading based in Taiwan, please contact us here.

USDT Taiwan Group – 11.5k members

This site is an aggregator of many other services that have alternative contact methods.

https://www.instagram.com/aoc_usdtotc/

In-person OTC crypto asset services

We have identified several in-person OTCs that offer varying services and may or may not be affiliated with major exchanges or stablecoin issuers.

> To see a map of those we have located, please contact us here.

For a comprehensive list of Peer-to-Peer (P2P) exchange services, contact us here.

Other services may exist, such as Bisq. These rely on specialised software applications for access.

Taiwan has made accessing cryptocurrency easier through ATMs, with even major chain grocery stores like “Family Mart” installing Bitoex ATMs in some of their outlets. Cryptocurrency ATMs can be easily found using services like Coin ATM Radar, a global index of cryptocurrency ATM locations.

Local media has reported that some homeowners have started accepting Bitcoin as payment, while others have also been open to receiving ETH or USDT.

We found the sellers selling USDT on Shopee online site. The sites and services are adopting payment applications, such as Credit Cards, Apple Pay, Google Pay, Bank Transfer to buy crypto.

On Coinsbee, users are encouraged to purchase gift cards from Apple iTunes, Amex, Amazon, Walmart, Uber Eats, eBay, Sephora, etc., through cryptocurrency and gateways such as Binance Pay and Crypto.com Pay.

Bitrefill, also allows users to purchase Carrefour gift cards through cryptocurrencies like Bitcoin, Lightning, Ethereum, Binance Pay, USDT, USDC, Dogecoin, Litecoin, and Dash.

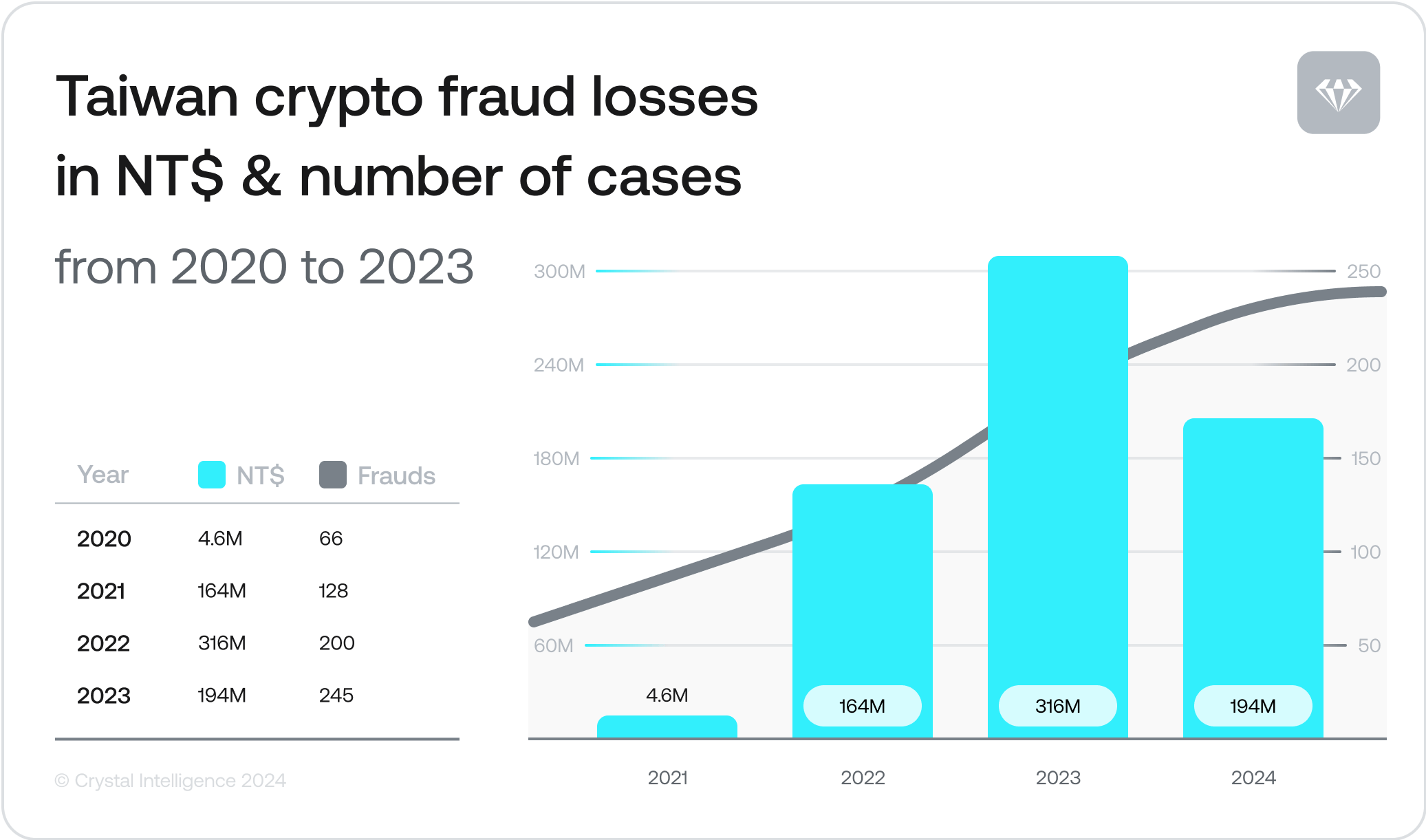

Taiwan’s financial losses to crypto-related fraud cases from 2020 to 2023 have totalled almost NT$679M. Although the monetary losses dropped in 2023, the number of crypto-related fraud cases has continued to rise at an alarming rate: from just 66 in 2020 to 245 in 2023.

See how Taiwan’s crypto crime trend compares globally by reading our 2024 Hacks & Scams report here.

The most common typologies seen are fake investment fraud, fake dating investment fraud (collectively known as “pig butchering scams“), online gambling, and phishing attacks.

OTC exchanges and ATM/BTM are often also involved in scams and money laundering. As KYC is lacking for OTC and ATM/BTM, these platforms are easily accessible channels for money laundering activities.

Crypto Ponzi schemes also happen in Taiwan. HK exchange MYCOIN defrauded NT$100M in Taiwan in 2014. Another HK exchange, JPEX, also set up office in Taiwan and defrauded investors of as much as NT$120Min 2023

Some sources credit Taiwan as the birthplace of the now infamous “pig butchering scams”, which originated from telecom fraud syndicates in the early 1990s, though this is not well substantiated. Following action against the perpetrators by Taiwanese law enforcement, operations later relocated to the province of Fujian in mainland China.

In turn, due to crackdowns by the Chinese government, many of these syndicates were forced to leave China and relocate to various Southeast Asian countries, such as Myanmar, Cambodia, the Philippines, and Laos, as per the September 2023 report by the United Nations Office on Drugs and Crime (UNODC). Notably, many of these compounds have a significantly large number of Chinese-speaking staff, who have often been trafficked to these locations.

Media has also reported that Taiwanese Organised Criminal Groups are involved in operating these latest scams, as well as related human trafficking and money laundering.

XREX exchange shared details about a pig butchering scam that targeted thousands of victims in Taiwan (145 victims verified).

Those scam sites moved their money into two main wallets:

0x14091f1d0a422Ccc678217EDfF90745D64bD9EB1;

0xbEeF863BC81ABEacE8689751009F069bE09ac3F0;

each wallet holds 5 million USDT are frozen by the Tether.

Taiwanese individuals are not only victims of cryptocurrency fraud but also fall prey to human trafficking, having been lured into these fraudulent operations under false pretences.

The Financial Supervisory Commission (FSC), along with the Central Bank, warned the public about the risks of dealing with bitcoins (which they labeled highly speculative virtual commodities”) and consolidated the caution by banning financial institutions from allowing bitcoin-related transactions at their ATMS in 2014. The former warning was repeated in December 2017.

Early signs of increased acceptance emerged when the country declared that virtual asset service providers must comply with local AML regulations

The FSC issued measures for preventing money laundering and combating terrorism financing by Virtual Assets Service Providers (VASPS).

The FSC designated cryptocurrencies with security properties as “securities” under the Securities and Exchange Act (SEA). This classification subjects their offer and sale to stringent regulations. Cryptocurrencies in Taiwan incur business tax (around 5%) and income tax (around 20%) on trading.

It has been reported that in 2021, the FSC enacted rules on crypto regulation aligned with the recommendations of The Financial Action Taskforce (FATF), thus further reeling virtual assets into the legislative framework governing the traditional financial sector.

The FSC approved a list of 24 AML compliant crypto trading platforms in terms of the Money Laundering Prevention Act.

Taiwan’s major cryptocurrency exchanges were reported to have formed a self-regulating association known as the ‘Taiwan VASP Association Preparation Committee’, anticipating the influx of regulations. Many local exchanges joined to support the crypto industry while collaborating with the regulatory authorities.

The FSC published a set of Guidelines for Virtual Assets Service Providers (VASPS), emphasizing the importance of investor protection, and implementing measures against money laundering and terrorist financing. The guidelines were developed with inputs from industry experts and corporate insights from international regulations from jurisdictions such as the EU, South Korea and Japan.

The FSC accelerated progress towards crypto regulation when it introduced the Virtual Asset Management Bill. The bill aims to provide better protection for customers while adequately supervising the industry.

The FSC’s cautious approach was encapsulated in its decision to observe global trends in the integration of the digital asset industry with the traditional economy, such as the US Securities and Exchange Commission’s (SEC) adoption of some spot Bitcoins as exchange-traded funds (ETFs) in January 2024, before moving forward.

The FSC took a firm step forward in its overall cautious approach towards the integration of cryptocurrencies with the traditional financial system, when it was reported to have resolved to propose a new draft bill aimed at regulating digital asset market trading in the East Asian financial hub in September.

The new four laws for combating fraud and preventing scams were proposed, enhancing fraud prevention and money laundering regulations, particularly targeting virtual asset service providers. These providers must register for money laundering prevention or face severe penalties. The Taiwanese Ministry of Justice immediately supported the move to further criminalize financial crime via crypto, which paved the way for adding custodial sentences to administrative penalties for criminals in the industry.

While the proposed laws were debated in Taiwan’s Legislative Yuan, or legislature, the country’s major crypto exchanges added to the momentum of virtual asset acceptance and AML/CFT compliance and regulation by forming the 24 member-strong ‘Taiwan Virtual Asset Service Provider Association’.

The LY passed the proposed AML/CFT measures into law.

The Taiwan Financial Supervisory Commission (FSC), in consultation with the Securities Business Association of the Republic of China, picked out five key points in allowing professional investors to invest in foreign virtual asset exchange-traded funds (ETFs).

Taiwan’s new laws require both domestic and foreign currency entities to register and comply with Taiwan’s stringent regulatory framework, aiming to increase transparency and legality in virtual asset transactions.

The country’s government is intensifying efforts to combat crypto fraud, likening it to drug crime enforcement, with major exchanges like Binance and XREX collaborating with law enforcement. Despite these measures, gaps in the legal framework for virtual currencies still pose risks for investors.

Regulatory vigilance

Introduce and reinforce regulations ensuring compliance and monitoring of crypto platforms to deter illicit activities and scams.

Public awareness

Launch awareness campaigns to educate users about the risks associated with crypto transactions, emphasizing the prohibition of illicit activities and scams.

Collaborative actions

Since cryptocurrency transactions have no borders, they can move from one country to another. We have seen local criminals also relocating to other countries and changing their nationality to avoid extradition. It is important to collaborate closely with foreign countries and be aware of corruption in those countries.

Enhanced due diligence

Implement stricter verification measures and due diligence procedures for crypto service providers to counteract illicit activities. Crypto crimes in Taiwan are not only related to scams, but also to human trafficking, money laundering, prostitution, and the illegal drug trade. Local gangs such as the Bamboo gangs have also been involved in crypto crime. It is essential to crack down on gangs’ criminal conduct to fight illegal activities in the crypto sector.

Heavier sentences for convicted scammers

Currently, the law’s punishment of crypto scam perpetrators in Taiwan is relatively light. Criminals involved in money laundering are sentenced to only one year in prison. Heavier sentences could serve as a deterrent to people considering engaging in criminal activities or repeating them.

Taiwan has historically approached the development of crypto legislation and regulation with caution. However, recent movements by the Financial Supervisory Commission (FSC) in 2023 and 2024 indicate a gradual shift towards integrating crypto with the country’s financial system. The passing of the LY anti-fraud Act on July 12, 2024, marked a significant turning point in this regard. Further developments in September 2024 could indicate a progressive and packleading approach in this regard.

To learn more and how to access our vast library of regional risk reports , contact us here.

News | February 11, 2026

South Korea seeks tighter crypto rules; US CLARITY Act nears; SARB warns stablecoins pose a risk to stability.

Investigations | February 5, 2026

Crystal analyzed $20.8M in peer-to-peer liquidity during Venezuela's crisis. Found institutional-scale operators and concentration risks most exchange

News | February 4, 2026

US regulators launch “Project Crypto,” 12 EU states miss DAC8 deadline, UK survey shows fewer, higher-value crypto owners.