Crystal Intelligence hosted this webinar to discuss the implementation of the GENIUS Act at both the state and federal levels, as well as its implications for the future of stablecoins.

It brought together a diverse panel of experts with decades of experience in both the public and private sectors to discuss the topic. It provided insights and guidance to stablecoin issuers, their compliance teams, and all industry stakeholders seeking to keep pace with the rapid development of the virtual asset industry in the US, as well as the accompanying regulatory jigsaw puzzle this has presented, and what to expect in 2026.

Dominic Schaffer, Crystal’s Director of Growth in the US and North America and a Graduate of the US Military Academy at West Point, moderated the panel, which included:

- Ken Chapman, Head of Institutional at XDC Network and Founding Partner at X10 Ventures,

- Joe Ciccolo, Founder & President of BitAML, and Executive Director of the California Blockchain Advocacy Coalition,

- And Joshua Radbod, Co-founder and CEO of the annual Crypto Banking Compliance and Stablecoin Summit, and Partner at Cogent Law.

Several audience polls were conducted during the webinar, with interesting and varied results.

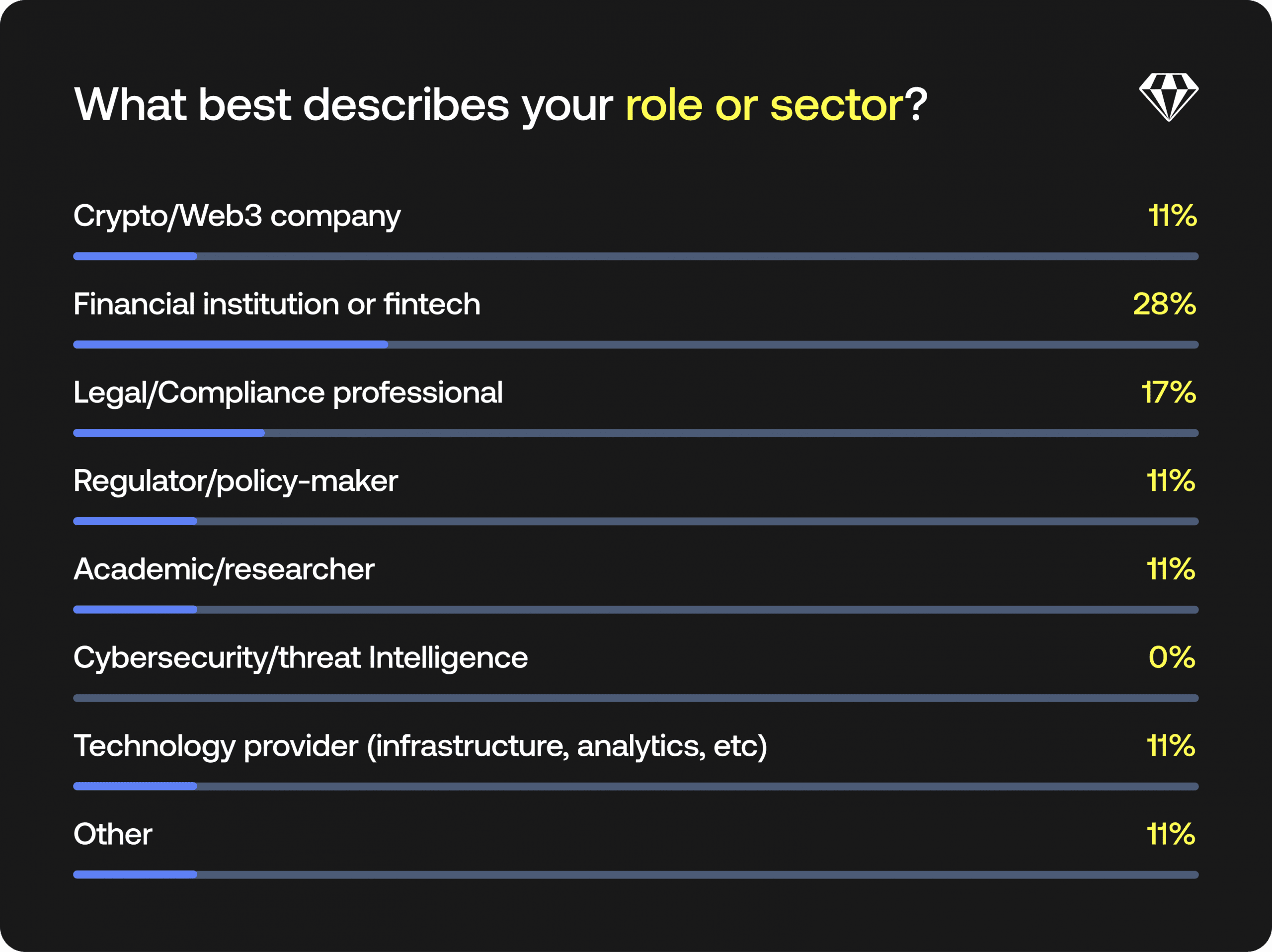

Poll #1 set the scene by asking who the audience was made up of:

Fintech representatives dominated with 28%, followed by legal and compliance professionals (17%). Strikingly,no one in the audience came from the cybersecurity or threat intelligence sector.

The current status of stablecoin adoption

Dominic opened the discussion with a quick description of the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act), which was passed in July 2025. Its purpose is to regulate stablecoins by creating a framework for issuers requiring 1:1 reserves and establishing consumer and national security protections. It further defines the reserve rules for stablecoin issuers and compliance requirements for digital asset payments.

The concerns and challenges of stablecoin adoption for financial institutions

Ken kicked off the discussion by raising what is sometimes regarded as a loophole in the GENIUS Act: While issuers in general are not allowed to provide interest on stablecoin investments, the Coinbase platform is permitted to do so, which banks tend to regard as unfair competition.

Additionally, while stablecoin investors are free to transfer their funds without notice, investors in banking products are not. These are issues that will undoubtedly have to be addressed as the federal government finalizes its regulations for stablecoin usage in the coming months.

State-level implementation of stablecoin regulations

Turning to the development of stablecoin legislation at the state level, several states have already acted. Wyoming led the way by establishing the Wyoming Stable Token Act in March 2023 and issuing its own Frontier Stable Token (FRNT) in August 2025.

Joe added that California was also proactive, passing its Digital Financial Assets Law (DFAL) in October 2023 and extending it in September 2024. Applications to establish crypto and stablecoin services must be submitted to the California Department of Financial Protection and Innovation by July 1, 2026.

He also highlighted that although New York State appeared to some as cautious in producing its stablecoin rulings, much of the work being done on the New York Bill has, in fact, informed what has now become the GENIUS Act.

Josh then touched on Illinois, which is gradually moving forward on crypto regulation through its Digital Assets and Consumer Protection Act and a version of the national Money Transmission Modernization Act, which different states are obliged to implement in whole or in part.

While these and many other states are developing stablecoin regulatory frameworks, state laws will be subject to federal rulings, which means they will likely need to adjust their regulations to align with the federal ones once they become available.

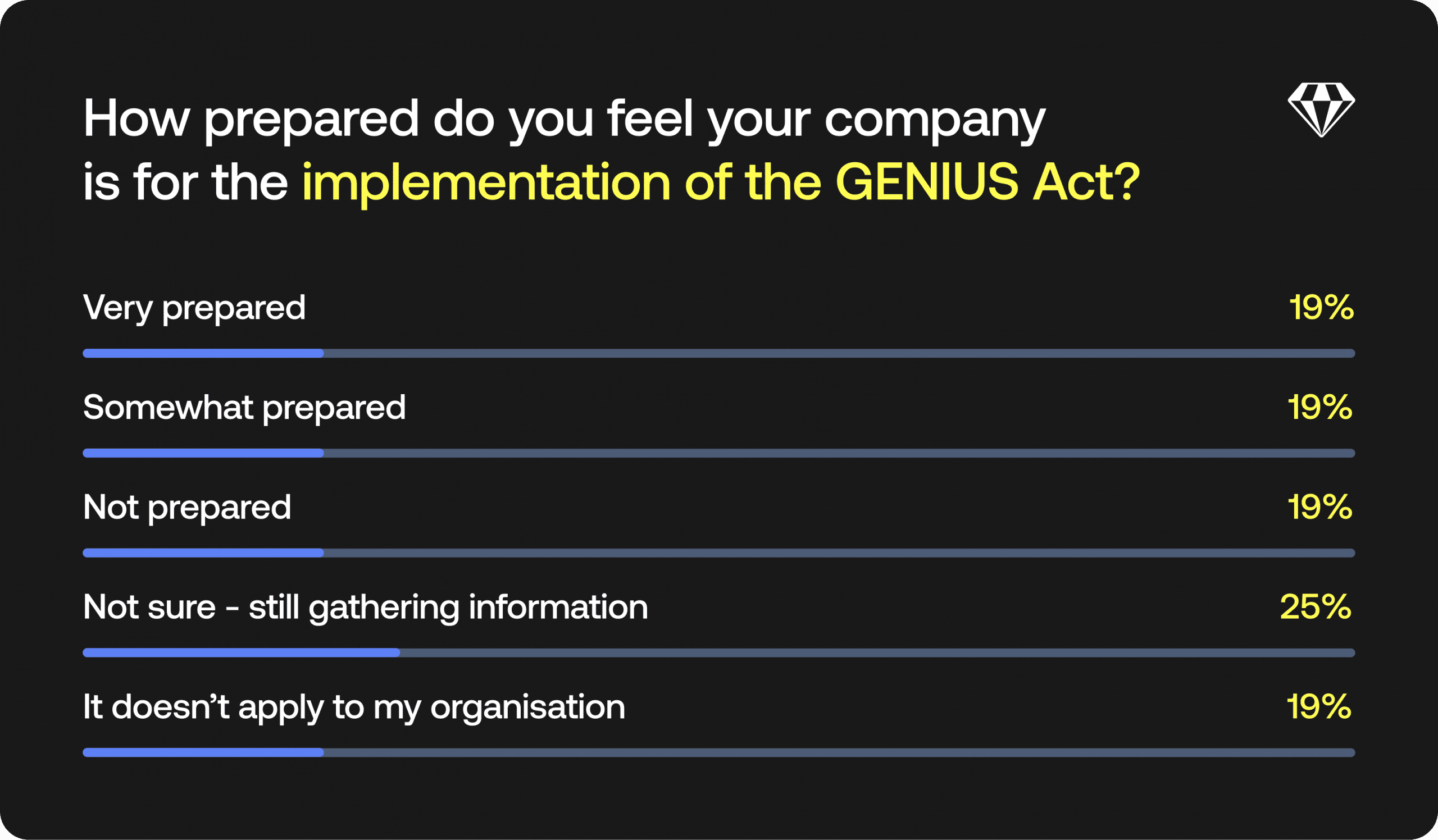

Poll #2 then asked the audience about their levels of GENIUS Act readiness:

Revealingly, 63% of the respondents were unprepared (19%), unsure (25%), or felt it was irrelevant to their organizations (19%). Just 19% felt well prepared

Uncertainty about stablecoin adoption in the corporate sector

The panel now turned its attention to the concerns that “keep industry players up at night”.

Joe said that although there’s information that tells stakeholders what to expect, it’s not yet clear operationally and tactically.

With many unknowns remaining, uncertainty is a concern. States are likely keen to avoid another debacle like the 2022 Terra Luna crash, which resulted in a market capitalization loss of over $50 billion for UST/LUNA and gouged an estimated half a trillion USD from the broader crypto market. They are cautious to follow the rules so as not to make a critical mistake or an error of judgment. States also want to adhere as closely as possible to federal requirements, which are yet to be finalized.

Ken added that global corporations must adapt to the speed at which transactions occur, making it difficult for them to keep pace. They also facea new environment where there is quicker adoption than what was thought possible just a few years ago. For example, until 2025, corporate stablecoin adoption had appeared to be fiveto ten years away.

However, the Securities and Exchange Commission (SEC) chairman, Paul Adams, surprised the industry in early December 2025 by suggesting that the tokenization of securities could occur “within a couple of years”.

It appears developments are now at an inflection point, with rapid adoption likely to acceleratein the coming years. One reason for this is the easing of what some felt was a draconian and punitive environment, where companies were nervous about making any errors in an atmosphere of uncertainty, fearing the wrath of the federal government.

However, some punitive investigations have now been halted, the GENIUS Act is in place, and federal rulings are pending. Opportunities are now emerging at an acceptable level of risk for savvy innovators who surround themselves with qualified legal counsel, ask the right questions, and comply with all relevant regulations. Joe added that companiesnow feel far more comfortable moving forward than they did just a year or two ago.

Josh also agreed, mentioning some notable acquisitions that made headlines in late 2025, including the $2B Mastercard acquisition of Zero Hash and the $1B Stripe purchase of Bridge Network, making it a favorable time for these companies.

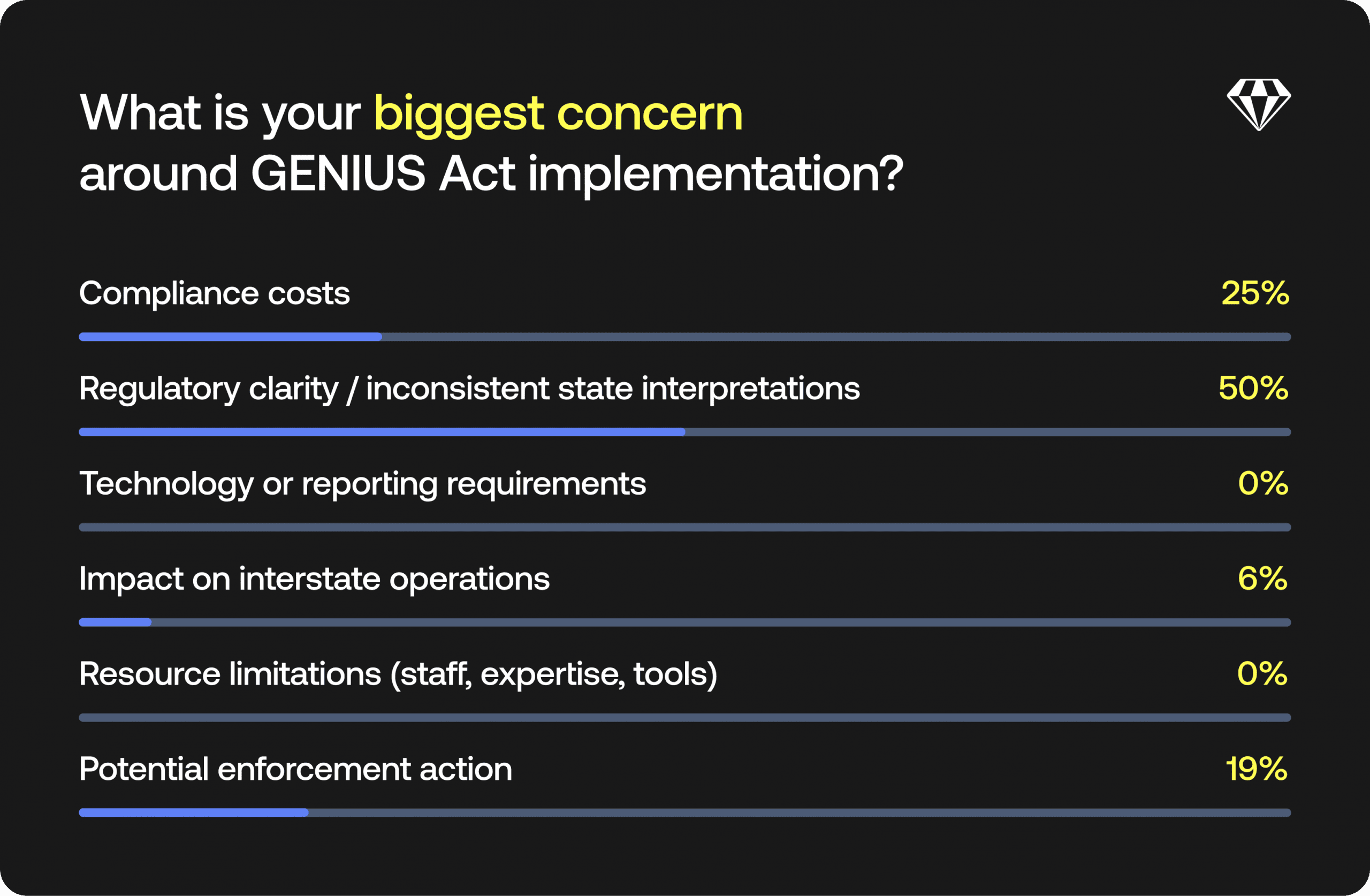

Poll #3 asked the audience what its biggest concerns are about how the GENIUS Act will be implemented:

A full 50% of the respondents cited a lack of regulatory clarity or inconsistent applications of the Act from state to state. Next were compliance costs (25%) and possible law enforcement action (19%).

The opportunities driving stablecoin adoption among corporations

In the new economic environment, where major institutions are accepting the growth of stablecoins as a form of payment, the panel turned to the question of why and what market opportunities make stablecoins so attractive.

The panel agreed that a major motivating factor is the ease of cross-border payments. One such area on a humanitarian level is that funds can be instantly transferred into disaster areas or war zones (or even directly to refugees), where there are either no banks or beneficiaries are unbanked, and avital urgency exists to dispatch and receive funds.

In traditional banking, there are several middlemen along the way, which delays the payment and reduces its value by taking their cut. With stablecoins, one can be assured that the funds will arrive immediately, intact, and in the hands of the intended recipient only. This also makes stablecoins a significant boon for migrant workers in richer countries, enabling them to remit funds to family members in under-or unbanked countries.

Another critical use case is in unstable countries where the local currency is unstable. Josh experienced this personally after recently spending two months in Argentina, where the Argentinian Peso was losing value by the week. He found that merchants such as restaurants were extremely grateful to be paid in stablecoin, rather than the volatile local currency. If a stablecoin is registered and compliant with regulations, it is considered reliable.

Looking to the future of stablecoin regulation under the GENIUS Act

Ken predicted that rapid adoption is likely in the future, as the crypto industry has undergone extensive learning, education, and the establishment of new rules. Likening the current atmosphere to the start of a race, he said the starting gun is about to go off, meaning the entire sector will focus on moving ahead over the next few years. As the regulatory environment stabilizes, new stablecoins are likely to emerge, and both major and minor players will find their respective niches.

Josh briefly touched on implementation, commenting on what he called ‘federal pre-emption’ for federal-qualified stablecoin issuers, inquiring which rule set will cover their money transfer rules. He added that he intended to follow federal guidance on the matter closely.

Dominic added that at this stage, attention will likely focus on the tokenization of real-world assets as the new paradigm and suggested this as a possible topic for discussion in a future webinar.

How rapid stablecoin adoption will impact the so-called ‘middlemen’

In response to a question from the audience, the panel then discussed the future of middlemen, who, in a world of to-scale stablecoin adoption, might find that their roles will become obsolete. If consumers buy and sell with stablecoins, they will bypass traditional transmission service providers, where the merchant is charged a fee on every transaction and recoups through their pricing decisions. Meanwhile, conventional banking processes that occur through payments via Venmo or PayPal couldbecome superfluous.

So, what happens to all the administrative employees whose jobs will no longer be needed? And will the customer have the same level of security without the traditional custodial role they currently play? The panel seemed optimistic that custodial operations would remain, and that administrative roles would evolve as the environment grew, allowing staff to take on different roles while still being directly engaged in securing customers’ interests.

What the crypto industry can expect in 2026 and beyond

Ken explained that the DTCC has been examining the future environment for almost a decade, as have the Bank of New York, Mellon, State Street, Northern Trust, J.P. Morgan, and other major institutions.

Josh added that one to watch is Elon Musk’s X, which allegedly plans to launch its own all-in-one platform. They have been acquiring money transmitter licenses ‘almost secretly,’ which will enable people to transfer cryptocurrency through the X App on their phones in the near future.

In a question about compliance, safety, and security, the panel was asked how to prevent illicit activity. Dominic highlighted that this is Crystal’s area of expertise. As it is highly relevant in this fast-developing field, he suggested security as a topic for another webinar in the future.

He then closed the webinar by thanking the excellent and well-informed panel for their time and valuable contributions to the discussion, as well as the audience for their interest in the topic. You can watch the webinar in full here.