Inside Brazil’s $2.22T peer-to-peer crypto market

Key takeaways:

- Crystal Intelligence analyzed 1,641 P2P advertisements representing $2.22T in trading capacity across nine platforms

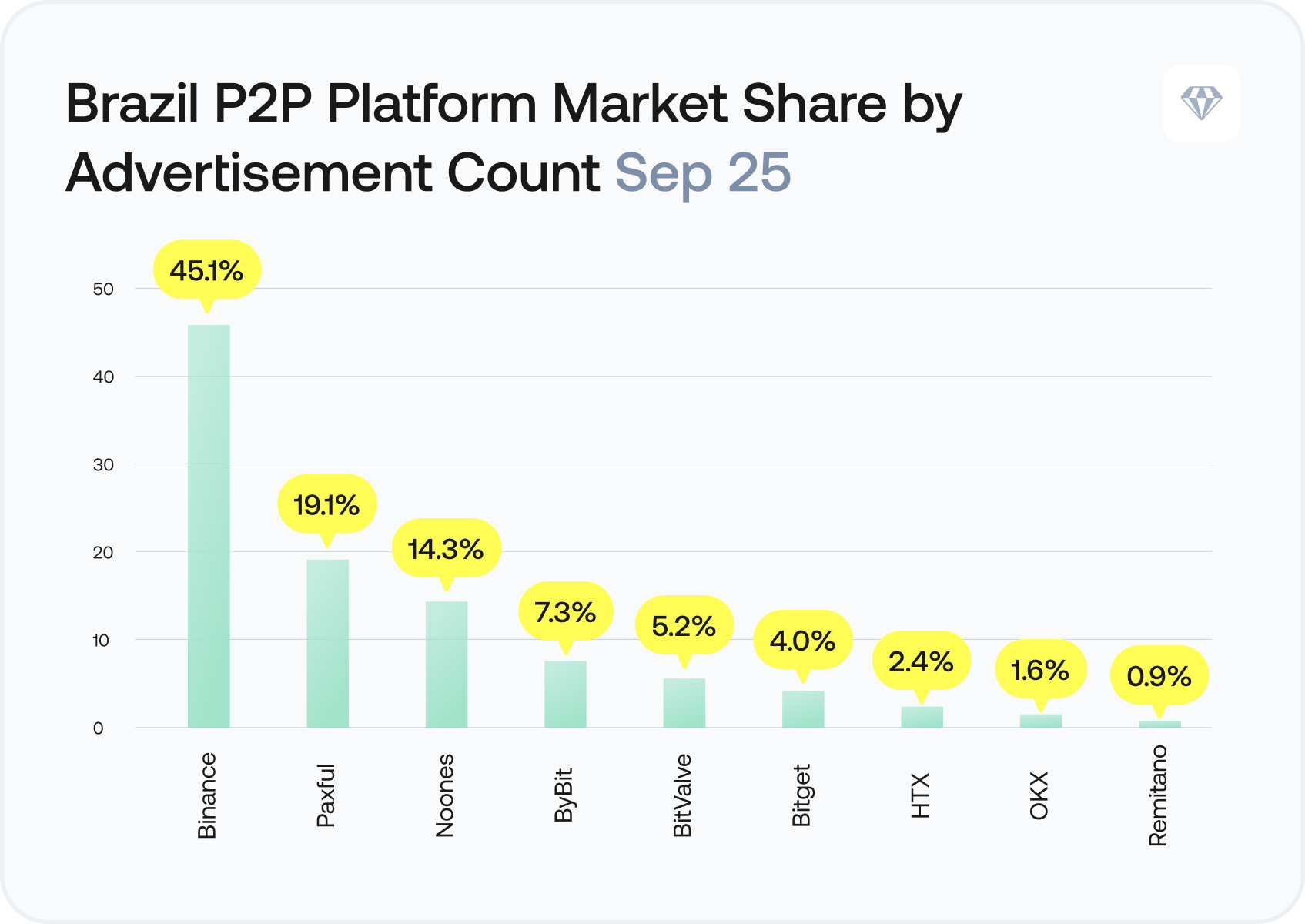

- Binance dominates with 45.1% market share; top three platforms control 78.5% of Brazil’s P2P market

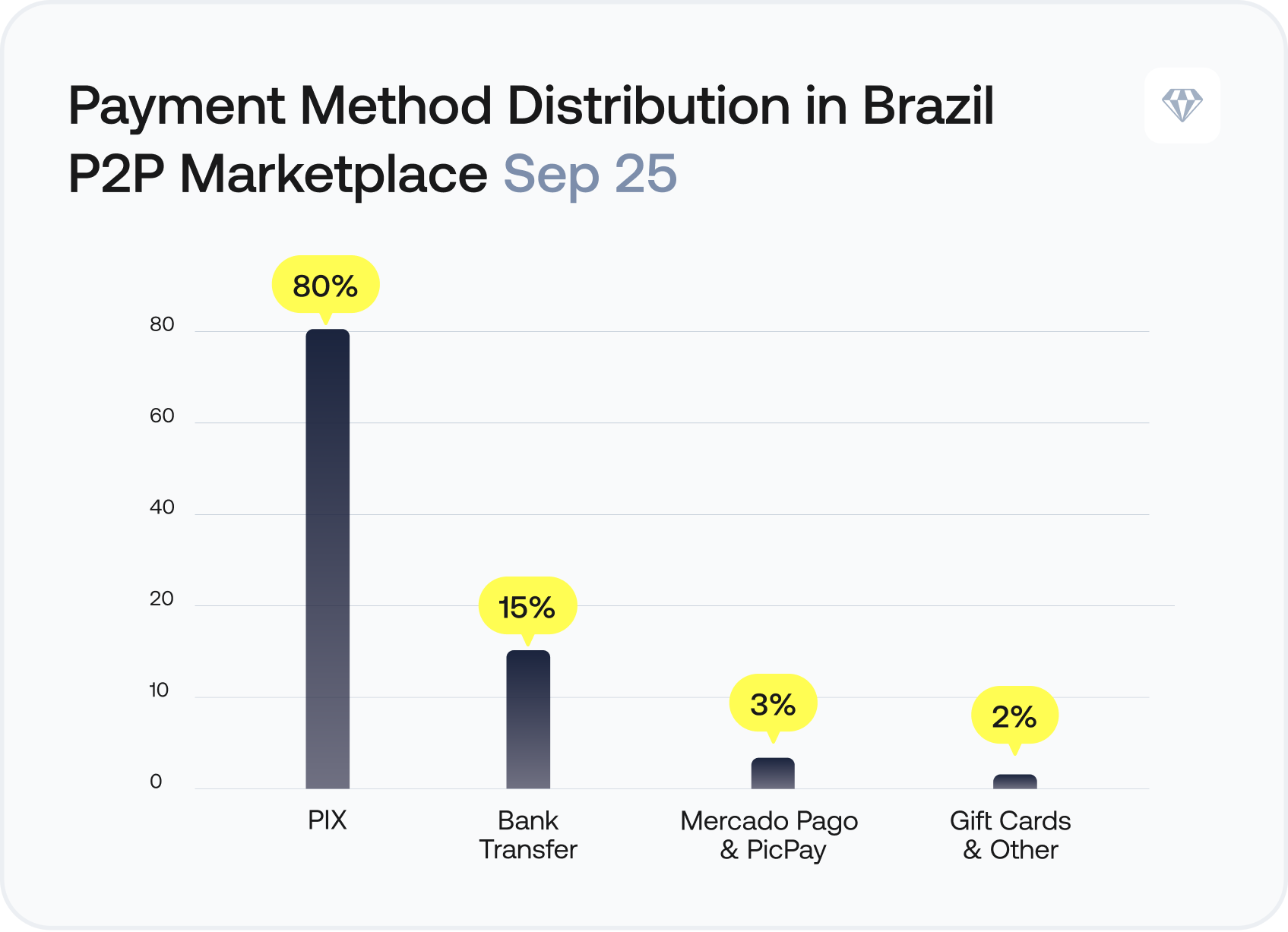

- PIX payment system appears in ~80% of P2P advertisements, enabling instant settlement that makes informal trading competitive

- Stablecoins (primarily USDT at 46.2%) dominate P2P activity—Brazilians prioritize price stability over speculation

- February 2026 regulations force major platforms to choose: full VASP compliance or Brazilian market exit

Beyond Brazil’s regulated exchanges lies a massive parallel economy: $2.22T in advertised peer-to-peer cryptocurrency trading capacity operating largely outside traditional oversight. As February 2026 brought comprehensive VASP licensing requirements, this informal marketplace faces its biggest disruption yet.

Our analysis of 1,641 active advertisements across nine platforms in September 2025 reveals market dynamics that will determine whether Brazil’s regulatory framework successfully channels activity into compliant channels, or pushes it further underground. For VASPs evaluating Brazilian market strategy, understanding these patterns is a must.

This is what the data shows.

The scale of Brazil’s peer-to-peer marketplace

The numbers are substantial. Crystal Intelligence’s September 2025 analysis identified 1,641 active peer-to-peer cryptocurrency advertisements across nine major platforms, representing more than $2.22T in advertised trading capacity. This sophisticated parallel financial system serves millions of Brazilians who prioritize speed, accessibility, and often anonymity over traditional exchange services.

What makes this significant isn’t just the volume. It’s that this marketplace operates with minimal regulatory oversight, creating both opportunity and risk. While centralized exchanges implement know-your-customer requirements, asset segregation protocols, and regulatory reporting, peer-to-peer platforms facilitate direct transactions between individuals with varying degrees of verification.

The informal nature creates appeal. Users can trade quickly without extensive documentation, access competitive rates, and move funds through Brazil’s instant PIX payment system. But the same characteristics that make peer-to-peer attractive for legitimate users also make it ideal for money laundering, tax evasion, and fraud.

February 2026 changed everything. Brazil’s new VASP licensing framework doesn’t explicitly regulate peer-to-peer platforms, but it will force major platforms to choose: implement full KYC and reporting standards, restrict Brazilian operations, or face enforcement action. The market concentration data shows why this matters.

Platform concentration drives market dynamics

Three platforms dominate Brazil’s peer-to-peer landscape, controlling nearly 80% of advertised activity. This concentration creates both efficiency and vulnerability.

Binance peer-to-peer leads decisively with 741 advertisements representing 45.1% of the market. This dominance reflects Binance’s broader position in Brazilian crypto markets, where it offers localized Brazilian Real on-ramps, PIX integration, and Portuguese-language support. For VASPs assessing competitive positioning, Binance’s peer-to-peer infrastructure represents the benchmark.

Figure 1: P2P Platform Market Share. Top three platforms control

78.5% of advertised activity. Source: Crystal Intelligence, September

2025.

Paxful captures 19.1% of advertisements with 314 active listings, while Noones holds 14.3% with 234 advertisements. Together, these three platforms account for 78.5% of Brazil’s advertised peer-to-peer capacity. The remaining 21.5% fragments across six smaller platforms including ByBit, BitValve, Bitget, HTX, OKX, and Remitano.

This concentration creates strategic implications. When major platforms implement compliance measures, or exit markets, they don’t just affect their own users. They reshape the entire ecosystem. If Binance tightens Brazilian peer-to-peer requirements to meet VASP standards, nearly half the market must adapt or migrate.

The February 2026 question is whether this migration moves toward compliance or away from it. Smaller, unregulated platforms may capture users who prioritize anonymity over legitimacy.

Alternatively, users may shift to compliant centralized exchanges if peer-to-peer friction increases. Market consolidation is inevitable, but the direction remains uncertain.

For global VASPs evaluating Brazilian entry strategies, these dynamics matter. Competing with Binance’s peer-to-peer infrastructure requires either matching their scale and localization or differentiating through superior compliance positioning. There’s no middle ground.

PIX integration reshapes settlement infrastructure

Brazil’s instant payment system PIX appears in approximately 80% of peer-to-peer cryptocurrency advertisements, fundamentally changing how Brazilians trade digital assets. This integration represents more than payment method preference. It’s the infrastructure layer making peer-to-peer crypto practical for everyday users.

Figure 2: Payment Method Distribution. PIX dominates as the preferred

settlement method at 80%. Source: Crystal Intelligence, Sept 2025.

Launched in 2020, PIX enables instant, 24/7 bank transfers between individuals and businesses at near-zero cost. Within peer-to-peer crypto markets, PIX solves the settlement problem. Buyers transfer Brazilian Reais instantly to sellers, who release cryptocurrency immediately. The entire transaction completes in minutes rather than the hours or days required for traditional bank transfers.

This speed creates liquidity. Our analysis shows traditional bank transfers account for only 15% of payment methods in peer-to-peer advertisements, with alternative processors like Mercado Pago and PicPay comprising 3%, and gift cards or other methods making up the remaining 2%. PIX captured 80% dominance because it’s the only payment rail fast enough to compete with centralized exchange user experience.

But PIX integration creates regulatory complexity. Brazil’s Central Bank now classifies certain stablecoin transactions as foreign exchange operations, requiring reporting to COAF (Brazil’s Financial Intelligence Unit). When peer-to-peer trades involve PIX for settlement and stablecoins for the asset, they potentially trigger both payment system oversight and virtual asset regulations.

The fraud dimension adds urgency. According to Silverguard’s 2025 analysis, $5.4 billion was stolen through PIX and payment voucher scams in Brazil during 2025, representing 56.8% of all social engineering losses. While not exclusively crypto-related, the integration of instant payment rails with pseudonymous cryptocurrency transactions creates exploitation

opportunities that Federal Police investigations have documented organized crime systematically using.

For VASPs, PIX integration is non-negotiable for Brazilian market success. But it requires robust fraud prevention, transaction monitoring, and reporting infrastructure that goes beyond typical cryptocurrency exchange requirements. The platforms that solve this integration while maintaining compliance will dominate post-February 2026.

What February 2026 regulations mean for peer-to-peer markets

Brazil’s VASP licensing framework creates a compliance watershed.

The three-tier authorization structure requires Virtual Asset Intermediaries to maintain minimum capital of $181,500, Virtual Asset Custodians $363,000, and Virtual Asset Brokers up to $907,500 depending on services. These capital requirements come with ongoing operational obligations: governance standards, asset segregation protocols, and mandatory reporting matching traditional financial institutions.

For major peer-to-peer platforms, compliance costs are substantial but manageable. Binance, Paxful, and Noones operate globally with existing compliance infrastructure. Adding Brazilian-specific requirements, while expensive, doesn’t fundamentally threaten their business models. The question is strategic priority: Is Brazil’s market worth the investment?

Brazil’s 6.5 million crypto investors make it Latin America’s largest market. VASP licensing aims to formalize this activity, not eliminate it. Platforms that achieve authorization gain competitive advantage through legitimacy. Those that don’t, could face enforcement action and potential market exclusion. The real disruption targets smaller, unregulated platforms. The bottom six platforms in our analysis (ByBit, BitValve, Bitget, HTX, OKX, and Remitano) collectively represent 21.5% of advertisements but lack the scale or regional focus to justify Brazilian VASP authorization costs. There’s a possibility they might restrict Brazilian access, consequently consolidating market share among compliant leaders.

But if this happens, where do displaced users go? Ideally, they migrate to authorized platforms, bringing informal trading activity into regulatory visibility. Pessimistically, they shift to truly unregulated channels like WhatsApp groups, Telegram chats, and local cash-to-crypto networks impossible to monitor or control.

Our report’s analysis suggests Brazil’s approach is pragmatic. Rather than ban peer-to-peer trading (which would be unenforceable), regulations create incentives for platforms to implement oversight while maintaining user accessibility. Success depends on enforcement credibility and whether compliant platforms can match the informal market user experience.

Strategic implications for VASPs and compliance teams

Brazil’s peer-to-peer market data reveals three strategic imperatives for organizations evaluating Brazilian operations.

- First, PIX integration is mandatory infrastructure. The 80% payment method dominance means any platform without PIX support is automatically non-competitive. This requires Brazilian banking relationships, fraud prevention systems calibrated to instant payment risks, and real-time reconciliation capability. VASPs cannot outsource this, it’s core competitive differentiation.

- Second, stablecoin liquidity determines market position. With USDT representing 46.2% of peer-to-peer activity and stablecoins generally comprising 90% of transaction volume, any platform prioritizing Bitcoin or altcoin trading misreads Brazilian market demand. Brazilians use crypto for price-stable value transfer, not speculation. VASP product strategies must align with this reality.

- Third, compliance becomes a competitive advantage post-February 2026. The platforms that achieve VASP authorization earliest gain first-mover benefits in attracting users from non-compliant competitors. But authorization requires 6-12 months of preparation, including Brazilian entity establishment, capital deployment, systems development, and staff hiring. Organizations still evaluating Brazilian entry are already behind.

How Crystal Expert helps VASPs monitor P2P risk

VASPs must do more than understand peer-to-peer market dynamics. They must detect when peer-to-peer transactions indicate money laundering or fraud. Crystal Expert monitors peer-to-peer platforms to identify suspicious patterns that Brazil’s new VASP regulations require reporting to COAF.

Our platform traces peer-to-peer transactions across platforms, revealing connections to our database of 110,000+ attributed entities, including known criminal organizations. When a user conducts rapid conversion cycles like buying cryptocurrency on an exchange, immediately transferring to peer-to-peer platforms, and repeating the pattern across small amounts, Crystal’s real-time monitoring flags this structuring behavior.

Crystal Expert also detects cross-chain transactions that criminals use to obscure the source of funds. With coverage across 330+ blockchains, VASPs can trace the movement of funds from Brazilian P2P platforms to international destinations.

For compliance officers at platforms already operating in Brazil, the timeline is unforgiving. Authorization applications require detailed operational documentation, proof of capital adequacy, customer asset segregation protocols, and integration with Brazilian regulatory reporting systems. The Central Bank expects approximately 100 applications throughout 2026, suggesting processing delays are likely.

Download the complete Brazil regulatory and risk analysis

This analysis is an excerpt from Crystal Intelligence’s comprehensive Brazil Crypto Regulation & Risk Report 2026. The full report includes:

- Complete three-tier VASP licensing framework breakdown with capital requirements and authorization timelines

- Detailed analysis of $2.45 billion in organized crime money laundering operations and enforcement strategies

- Regulatory timeline and compliance roadmap for February 2026 enforcement

- Stablecoin market dynamics and criminal exploitation patterns

- Cross-border transaction reporting requirements beginning May 2026

Whether you’re a VASP evaluating Brazilian market strategy, a compliance officer preparing authorization applications, or law enforcement tracking illicit flows, this intelligence is essential for navigating Latin America’s largest crypto market transformation.

Download the full report.