This week, we bring you the latest updates and developments in the world of crypto compliance and investigations.

Bitcoin drops as German authorities move $172m+ seized assets while Mt Gox wallets also showed signs of movement

German authorities might be on the brink of liquidating seized crypto assets through exchanges after final confiscation. Yesterday, the German government made significant moves by transferring $172 million in seized Bitcoin to multiple locations. This action highlights ongoing efforts by authorities to manage and redistribute confiscated digital assets securely and efficiently.

Above: Visualisation from Crystal solution depicting how the seized funds have been redistributed by German authorities

This move aligns with the broader trend among governments and law enforcement agencies to efficiently manage digital assets acquired through criminal investigations or other enforcement actions.

When cryptocurrencies are confiscated, typically due to illegal activities such as fraud, money laundering, or drug trafficking, holding onto these assets can pose significant risks and complications. The volatility of the cryptocurrency market means that the value of these assets can fluctuate dramatically, potentially decreasing in value and resulting in financial losses for the state. By converting the seized cryptocurrencies into fiat currency promptly, German authorities aim to mitigate these risks and secure the monetary value for public funds.

The process generally involves transferring the confiscated digital assets to reputable cryptocurrency exchanges. These exchanges are chosen based on their security measures, compliance with regulatory standards, and their ability to handle large transactions without significantly impacting market prices. This approach not only addresses the practical concerns associated with managing digital currencies but also serves as a deterrent to cybercriminals.

By demonstrating the capability to track, seize, and liquidate illicit cryptocurrency holdings, German authorities reinforce the message that digital assets are not beyond the reach of law enforcement.

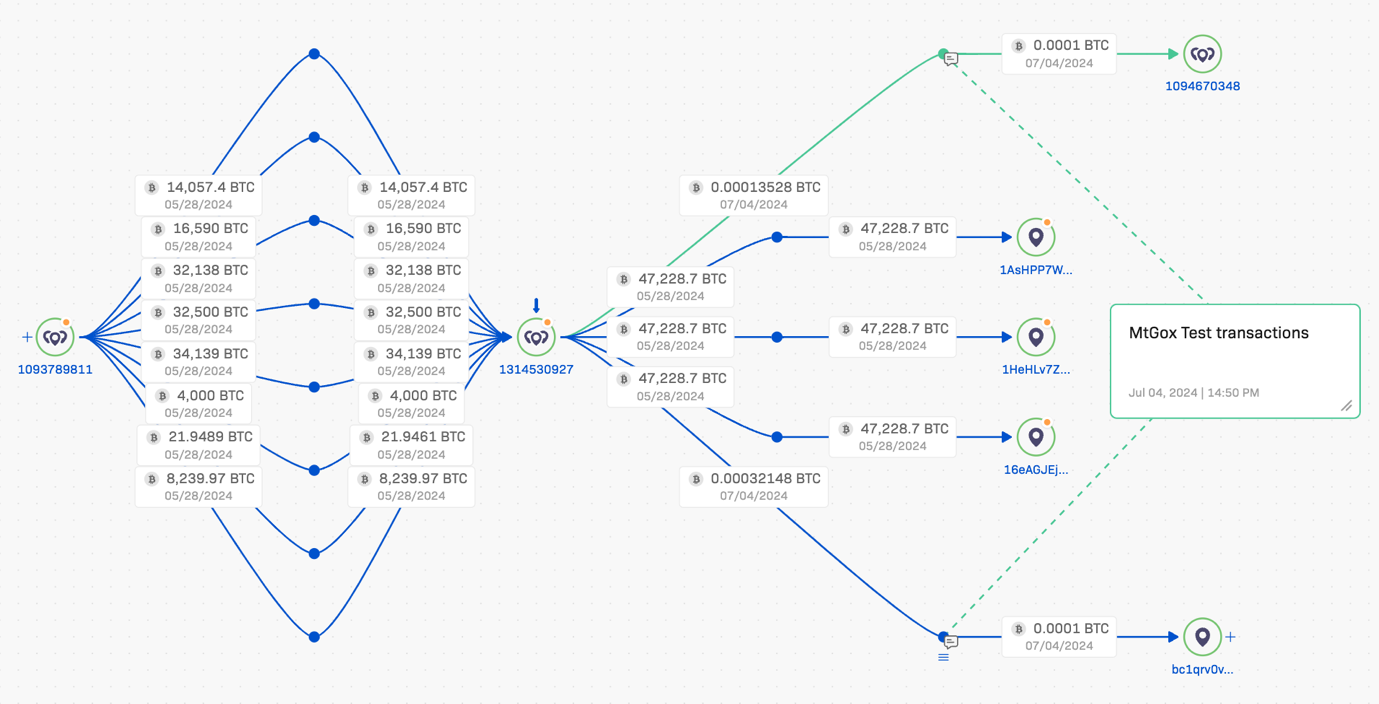

Separately, Mt Gox wallets have shown signs of test transactions.

Above: Transactions made on July 4, 2024 show the test transactions made from MtGox wallets.

Given that after years of litigation, MtGox creditors are about to receive compensation, in the regions of 100,000 BTC plus, there is speculation that some may rush to sell holdings which has also impacted Bitcoin prices.

Read more at cointelegraph.com

Normie memecoin flash loan exploit

On May 26, 2024, Normie memecoin faced a devastating flash loan exploit resulting in a profit of 224 WETH (approximately $881,686) for the attacker. This exploit drastically reduced Normie’s market capitalization from $41 million to a mere $35,000. The attacker later offered to return 90% of the stolen assets, contingent on specific conditions, showcasing a rare instance of post-hack negotiation.

Read more at cointelegraph.com

Pump.fun Solana exploit

Pump.fun, a Solana-based memecoin launchpad, was exploited by a former employee using flash loans to misappropriate approximately $1.9 million worth of SOL. The platform has since upgraded its contracts and promised to replenish the affected liquidity pools. This incident underscores the risks posed by internal actors and the importance of robust internal security protocols.

Read more at coin360.com

Gnus.AI Discord hack

The Gnus.AI network suffered a $1.27 million loss due to a token-minting exploit on May 5, 2024. The attacker used a compromised private key to create and sell fake GNUS tokens. In response, Gnus.AI plans to issue a new version of the token and partially compensate the losses. This case highlights the critical need for secure key management practices.

Read more at cryptometer.com

Based Doge (BOGE) exploit

On May 27, 2024, the Based Doge memecoin faced a similar exploit as Normie, resulting in the minting of new tokens and a significant market cap loss. The attacker drained approximately $16,926 worth of BOGE, exploiting a smart contract vulnerability. The team plans to relaunch the project and compensate the affected users.

Read more at CCN.com

Stay Updated

Crystal Intelligence is committed to providing timely and relevant updates to help you navigate the complex world of crypto compliance and investigations. Stay vigilant and informed.