2021 has witnessed big changes for the blockchain industry in innovation, trends, and in regulations. Read Crystal’s End of Year Report to get a comprehensive overview.

Blockchain Industry Trends 2021

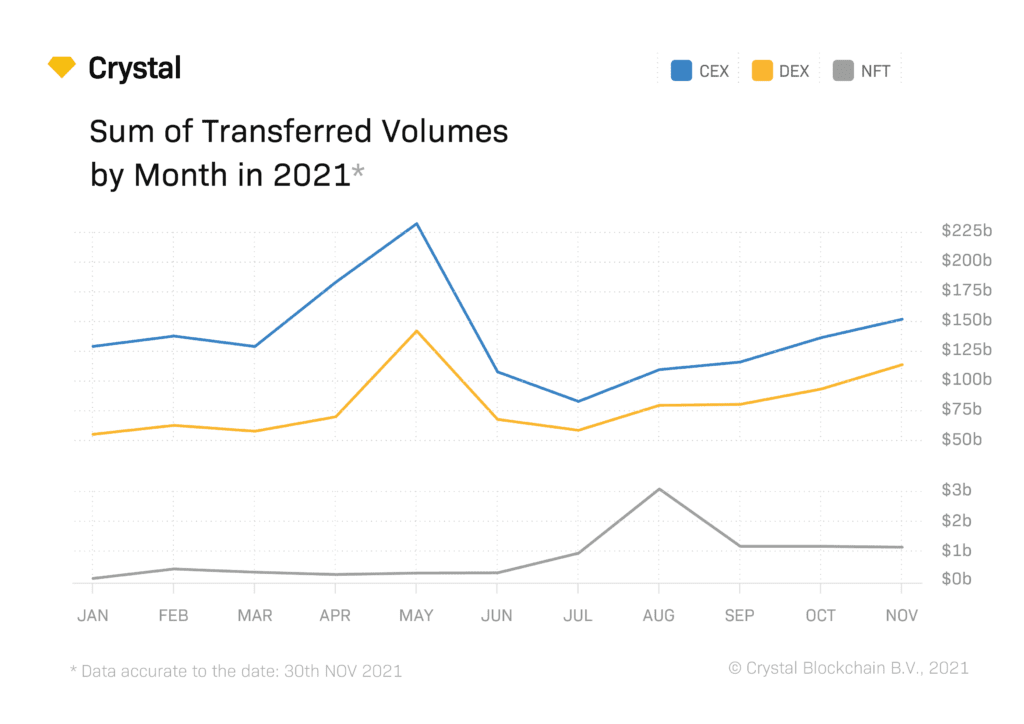

The decentralized economy made itself apparent in 2020 as a force to be reckoned with, and in 2021 it only proved to establish itself even further as a viable global economic ecosystem, with $111 billion worth of transfers being made via decentralized exchanges (DEXes) as of November 2021 (that’s up from $77 billion worth of transfers in August 2021). Read about how Crystal is developing a decentralized risk management solution.

NFTs (Non-Fungible Tokens) became a mainstream sensation in early 2021, with everyone from artists to footballers getting in on the game. NFT marketplaces began to appear, and total NFT sales went from $2 billion in Q1 2021 to $12 billion in November 2021. In March 2021, the most expensive NFT thus far sold for nearly $70 million USD. Read Crystal’s introductory article on NFTs, their use cases, and their potential risks.

Both NFTs and the DeFi sector were given their dues in the latest guidance from the FATF (Financial Action Task Force) as more clarity was given as to how regulators should define and view them. The FATF also clarified further its recommended requirements for the so-called “travel rule”, along with several other important definitions, to meet recommendations made by stakeholders from the crypto industry. Read Crystal’s latest article on what the FATF guidance means for the industry in 2022.

Sum of transferred volumes per month 2021 (CEX vs. DEX vs. NFT)

The graph above highlights the overall transferred volumes (sent and received) for CEXes (centralized exchanges), DEXes (decentralized exchanges), and NFTs (non-fungible tokens). According to the map, we can definitely observe a correlation between CEX and DEX volumes over the course of 2021. For example, a bull movement in May 2021 caused a heat-up of interest from investors, banks, and FIs, who had been observing record high prices of bitcoin and other cryptos that started in March 2021.

However, we can see that the market reacted again in June 2021, and transfer volumes on both CEXes and DEXes decreased. This was in part caused by China’s crypto ban, where there was a suspension of mining and crypto activities. After such a big jump and then a dramatic fall, the dynamics began to increase again in a more stable manner.

NFTs volumes have proven to be largely uncorrelated with CEX or DEX trade volumes.

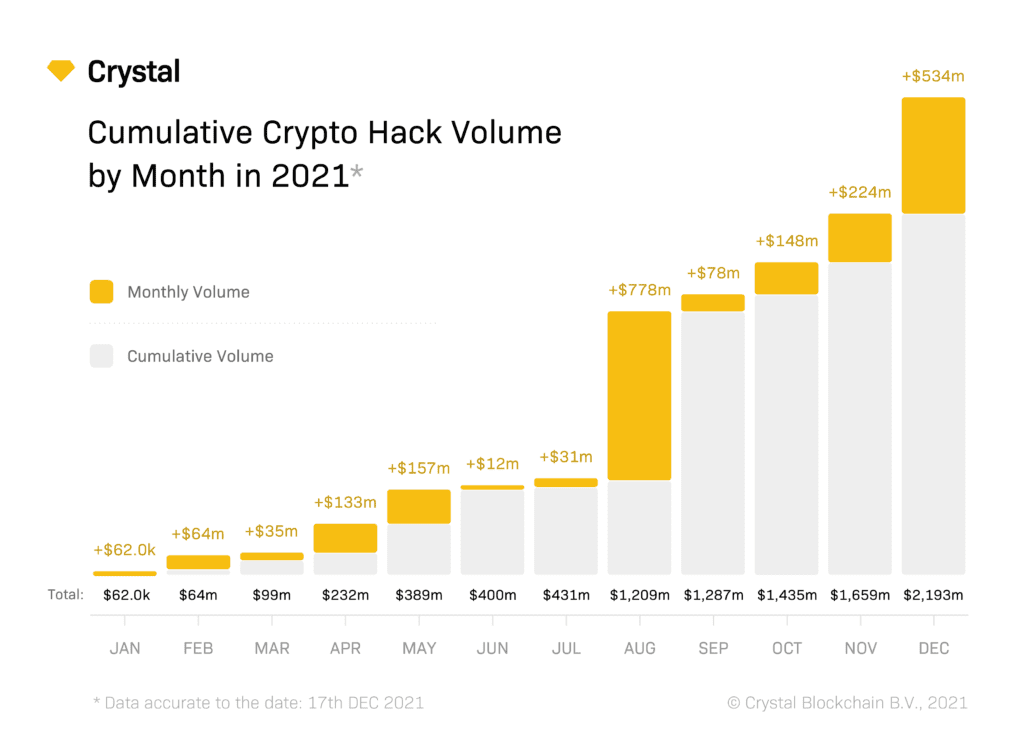

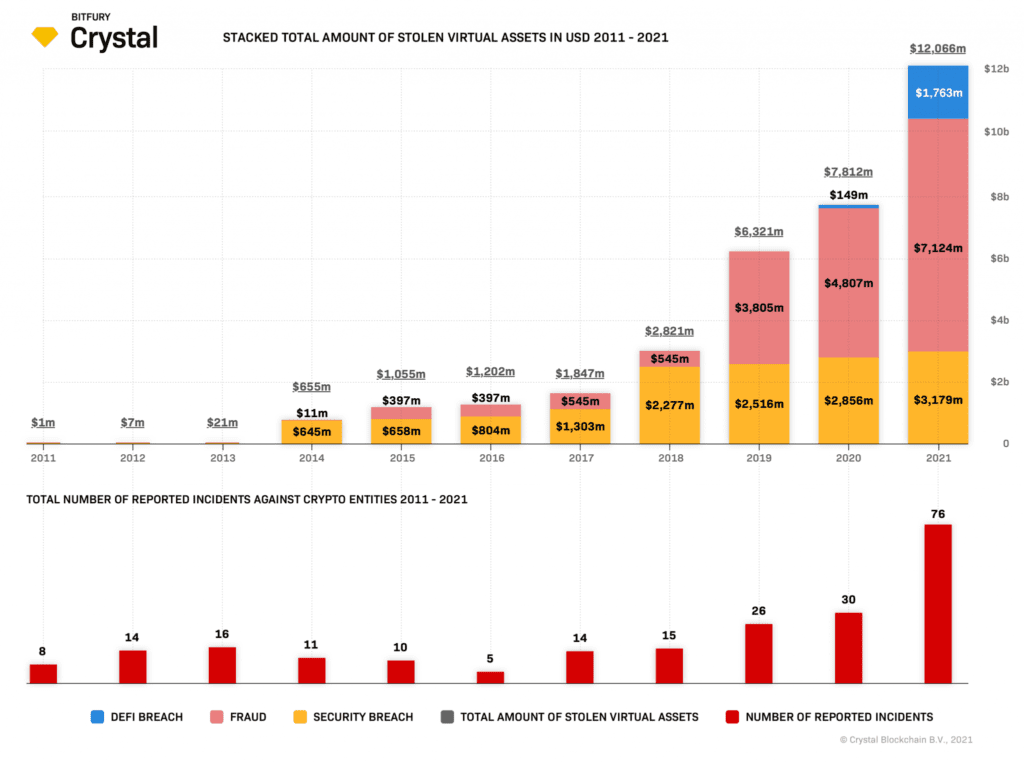

A rising trend in financial damage via cryptocurrency breaches in 2021

In 2021 we saw the financial damage from an increasing number of hacks in the cryptocurrency industry almost double what it was in 2020. There has also continued to be growing criminal dynamics in the last quarter of 2021. This is a worrying trend that will run into 2022, and we can see in the next section where the damage is happening.

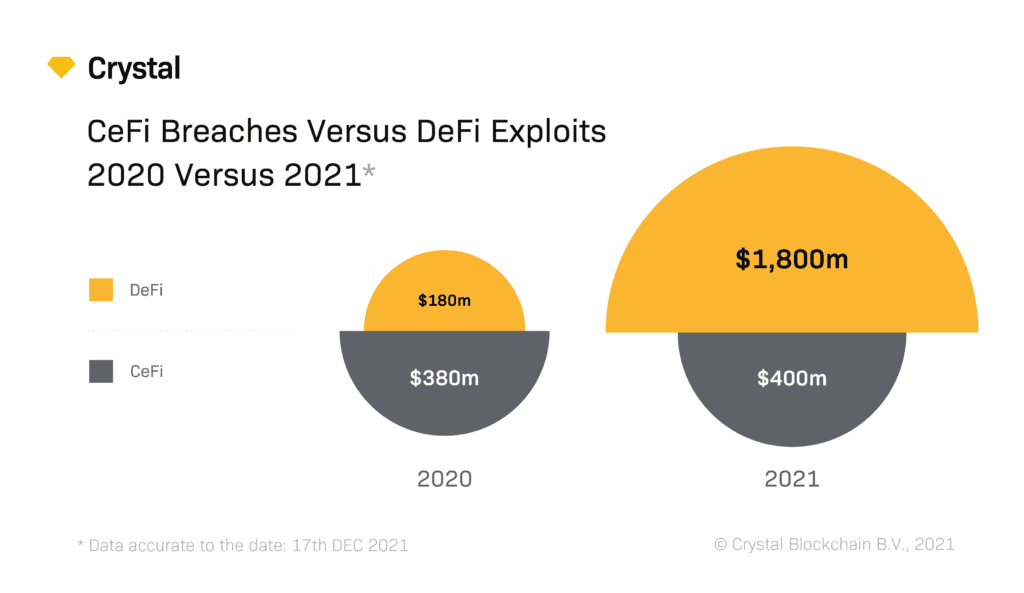

Cryptocurrency crime trends in CeFi versus DeFi (2020 versus 2021)

In 2021, we saw a major paradigm shift from 2020, where USD $380 million was stolen via CeFi (centralized finance) or CEXes (centralized exchanges) whereas USD $1,800 million was stolen via DeFi (decentralized finance) or DEXes (decentralized exchanges.)

Hackers moved their attention to DEXes (decentralized exchanges) in 2021. The number of attacks on DeFi (decentralized finance) has grown 4.5x – from 14 attacks in 2020 to 63 attacks in 2021. DEX losses via exploits increased 12x in 2021 compared to 2020.

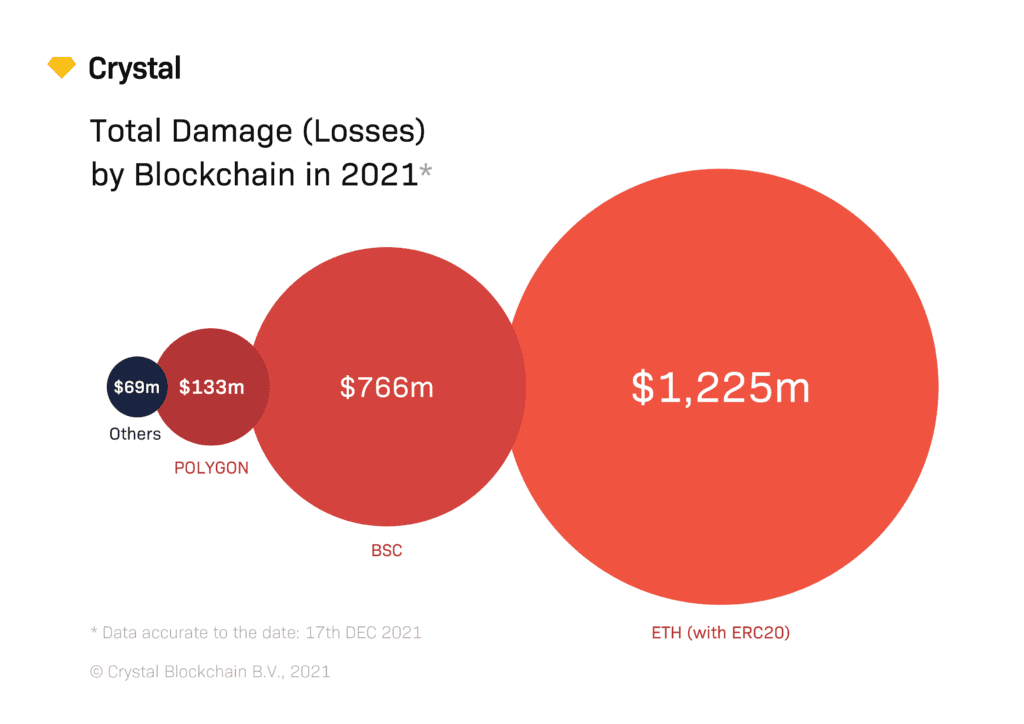

Biggest criminal losses per blockchain 2021

Ethereum (with ERC20 tokens) holds the leading position in 2021 at USD $1,225 million. This makes sense considering the amount of increased activity on the Ethereum blockchain, in general, in 2021. Binance Smart Chain comes second in its losses at USD $766 million in 2021, and Polygon comes in third with a loss of USD $133 million.

Biggest 10 CEX & DEX breaches 2021 (plus first NFT marketplace exploit)

| Breach Date | Entity Name | Entity Type | Amount Stolen |

| 8 October 2021 | PolyNetwork | DEX | US$601m |

| 12 May 2021 | Bitmart | CEX | US$196m |

| 11 January 2021 | BXH | DEX | US$140m |

| 13 December 2021 | Vulcan Forged | NFT (DEX) | US$140m |

| 27 October 2021 | Cream Finance | DEX | US$130m |

| 12 February 2021 | Badger DAO | DEX | US$120m |

| 19 August 2021 | Liquid | CEX | US$96m |

| 19 April 2021 | EasyFI | DEX | US$80m |

| 13 December 2021 | AscendEX | CEX | US$70m |

| 28 Apr 2021 | Uranium Finance | DEX | US$50m |

Key Analytics Reports from Crystal Blockchain

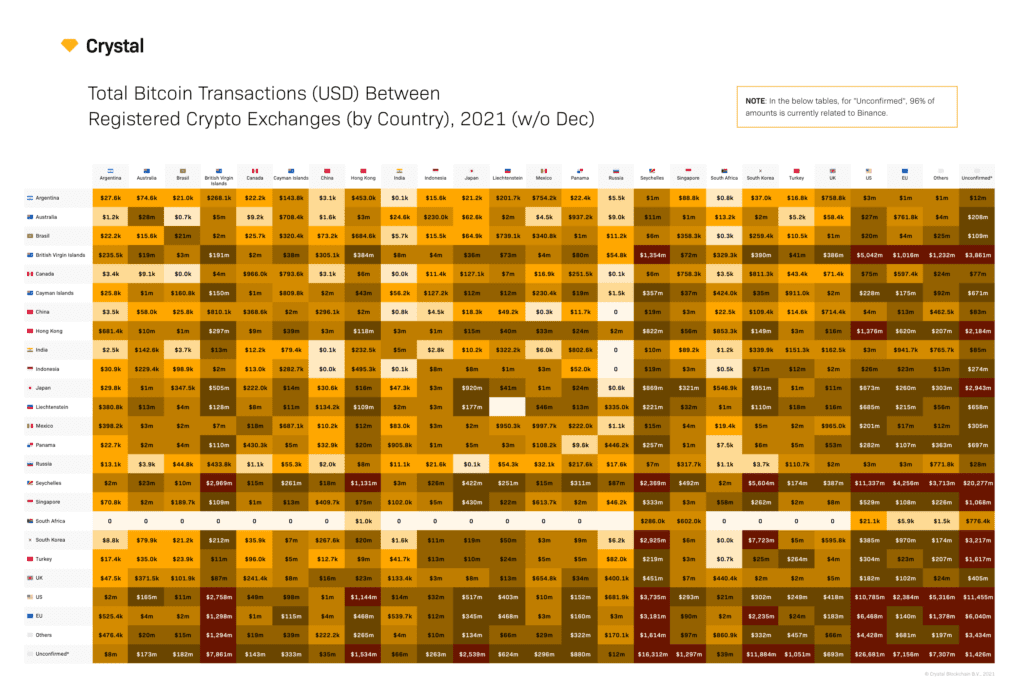

Geography of Bitcoin Dynamics Map & Report 2021

A comprehensive geographical representation of international blockchain transactions from one exchange to another between 2013-2021.

This interactive map with a comprehensive downloadable report shows the current and historical international bitcoin blockchain flow of transactions between countries and exchanges. The information on this map is updated bi-annually, and the prices are in US dollars. By the end of Nov 2021, the countries with the largest number of registered exchanges were the UK (70 exchanges), Singapore (47 exchanges), the US (40 exchanges), and Seychelles (35 exchanges). The total volume of bitcoin transferred between exchanges from January 2021 to November 2021 was almost $279 billion.

LINK TO INTERACTIVE MAP AND DOWNLOADABLE REPORT

Crypto & DeFi Hacks & Scams Map & Report 2021

Full, detailed analysis of all security breaches and fraudulent activities involving cryptocurrencies over the last 10 years.

(NOTE: The data on this graph is accurate to the date 8th December 2021.)

Cryptocurrency crime is growing in parallel with cryptocurrency markets. Approximately $12.1 billion in cryptocurrencies was stolen between Jan 2011 and Dec 2021. There have been 120 security attacks, 73 DeFi protocol exploits, and 33 fraudulent schemes. So far, $3.18 billion has been stolen through security breaches, $7.12 billion through scams, and $1.76 billion through DeFi hacks. In this report, you can explore the largest incidents of stolen funds involving cryptocurrencies over ten years, taking into account the way the incident happened and the volume of funds stolen.

LINK TO INTERACTIVE MAP AND DOWNLOADABLE REPORT

Interactive Map of Crypto Regulations Per Country 2021

In our latest interactive map, you can explore the regulatory stance of various countries and regions regarding digital assets around the world, as of December 2021. This is the most up-to-date map available right now! (Click on a region to go to the blog post.)

Read about current regulatory stances across the globe in 2021 for the following regions: Canada, the US, Latin America, the UK, the EU, Africa, Eastern Europe, Central Asia, South Asia, China, Japan & South Korea, South East Asia, and Australia & New Zealand. (We’ll be updating this map for 2022 with supervisory authorities per region!)

LINK TO INTERACTIVE MAP AND DOWNLOADABLE REPORT

Crystal revenue growth and business expansion in 2021

By Q4 2021, Crystal Blockchain can report that it has grown its revenue 3x since the same period in 2020. We have also been busy expanding our team in the UK, and we officially opened our new office in London this year.

In the summer of 2021, we launched our Investigations Services, headed up by Scott Pounder: see the most significant cases we assisted with this year here and here.

At the same time, Crystal also launched its key solution for AML compliance and risk mitigation in the decentralized economy: Crystal for DeFi via Clarity Protocol. Crystal will play an important role in the Clarity Protocol community as a democratic data provider.

Crystal coverage continues to expand for monitoring and tracking transactions on blockchains. Crystal can boast 98% centralized (CEX) coverage and 80% decentralized (DEX) coverage. Along with Bitcoin, Bitcoin Cash, Bitcoin SV, Ethereum, Ethereum Classic, Litecoin, Tether, Stellar, and Ripple, the platform now supports Dogecoin, Dash, Zcash, Algorand, Tron, EOS, Solana, Polygon, Cardano, and Binance Smart Chain.

Crystal can confirm 20% of all Bitcoin Blockchain transfers were verified by customers through the Crystal platform in 2021, proving the importance of this solution for overall safety and transparency within the blockchain ecosystem and crypto community.

Read about our latest feature – the Entities Directory – for efficient case management. We also continue to improve functionality for our best-in-class visualization solution. If you haven’t yet, you can also try the open Crystal Block Explorer, launched in September, which facilitates free transaction exploration and monitoring for the Bitcoin Blockchain.

Crystal established its end-to-end Travel Rule solution via our important partnership with Notabene, along with several other important partnerships and collaborations in 2021.

This year, the Crystal Blockchain team has become a trusted member of the Chamber of Digital Commerce, the International Association for Trusted Blockchain Applications (INATBA), Global Digital Finance (GDF), Cryptocurrency Compliance Cooperative (CCC), and Anti-Human Trafficking Intelligence Initiative (ATII), highlighting our vital role in the building of a better, safer blockchain future.

Industry Predictions for 2022:

What are some of the changing trends we see in crime and risk using cryptocurrencies?

- The rise in transaction volumes we see in general, and growing market caps across blockchains, leads to more activity and potential for more crime and risk.

- Full-scale cryptocurrency bans in countries like China make prices volatile. This can lead to rash decision-making and higher risk for businesses and individuals.

- Growth in the decentralized economy has led to correlated rising crime trends, with increased DeFi protocol transactions with little anti-risk structures in place.

- Multi-chain activity and cross-chain transactions (chain-hopping) require a more adaptable, scalable, and more complex set of blockchain analysis solutions.

- While there is more alignment in regional and global regulatory development, long-term large multi-jurisdictional investigations are becoming more prevalent.

In 2021, we observed such trends, and we are monitoring them closely as we move into 2022. Multi-chain analysis in particular makes monitoring and investigations more complex, as does multi-jurisdictional case management. This requires more expertise and vigilance from all players involved in this expanding market — from individuals to crypto service providers, to compliance officers, to investigators, to banks and FIs.

The Crystal Blockchain team is glad to be able to facilitate such Expert crypto vigilance.